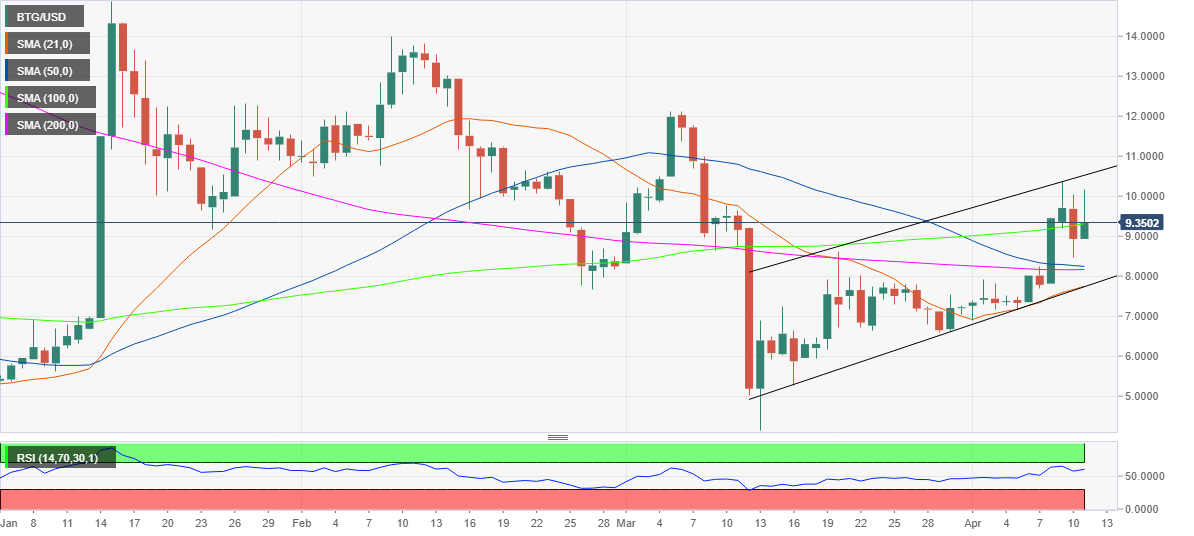

- BTG/USD is stuck in a rising channel since March 13.

- The coin is one of the top gainers amongst top 40 widely traded crypto coins.

- A likely rising channel formation on daily sticks points to the downside.

Bitcoin Gold (BTG/USD) witnessed a sharp recovery rally on Saturday after steep losses seen on Friday, as the price fell as low as 8.46. Despite the rebound, the coin failed to sustain above the 10 level for the third straight day so far, as the rates now move back to 9.50 region. The spot is off the highs, still up 5.50% on a daily basis while up a whopping 30% over the week. The market capitalization for BTG/USD stands at $166 million.

BTG/USD daily chart

The intraday picture for the coin appears rosy so long it holds above the 8.92 level, where the open price is the same as the low for the day.

However, the price remains exposed to downside risks over the coming few weeks, with a potential rising channel formation spotted on the daily chart.

Therefore, from a medium-term technical perspective, the immediate support is aligned near 8.20 levels, the intersection of the 50 and 200-daily Simple Moving Averages (DMA). The next support awaits at 7.75, where the 21-DMA and channel support coincide.

The daily Relative Strength Index (RSI) has turned flat but holds above the midline, suggesting the bulls may be losing conviction.

On the flip side, a daily close above the 10 mark will open doors for a test of the channel resistance at 10.52. Buyers will aim for the 11 barrier on a sustained move above the latter.

BTG/USD levels to watch