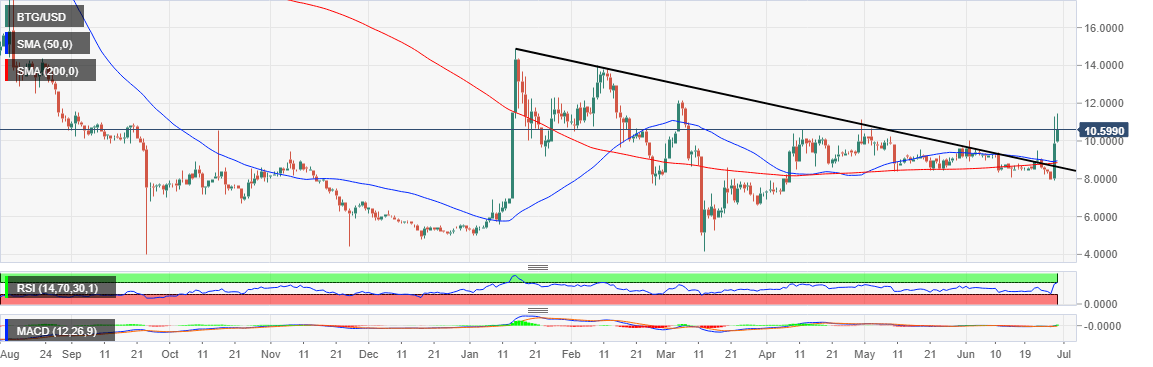

- Bitcoin Gold breaks several resistance zones including, the trendline, the moving averages and $10.00.

- BTG/USD overbought conditions suggest a shift in the focus from breaking $12.00 resistance to defending $10.00 support.

Bitcoin Gold is the biggest double-digit gainer on Monday during the Asian session. The digital asset is up 10.12% on the day to trade at $10.87 following an upward adjustment from $9.95 (opening value). Glancing up, an intraday high has been reached at $11.44 (temporarily) halting the momentum.

On the other hand, Bitcoin is barely holding above the short term support at $9,100. It has become an uphill task to sustain the price above $9,200 resistance zone. BTC/USD is trading at $9,125 after a 0.11% gain on the day. The other major cryptocurrencies are not any different from Bitcoin as they are also dealing with stronger bearish arms. For instance, Ethereum is up 0.36% to trade at $225 while Ripple is up 0.41% to exchange hands at $0.1770. The rest of the market is mixed red and green.

Bitcoin Gold technical analysis

Bitcoin Gold has indeed spiked incredibly on the first day of the new week’s trading. The daily chart shows an engulfing candle from the support at $8.00. The momentum cleared the resistance at both the 50-day SMA and the 200-day SMA. The bullish leg extended above a key descending trendline before taking down the seller congestion at $10.00.

For now, the biggest fight is to sustain the price above $11.00 and extend the bullish leg above $12.00. Unfortunately, further gains are unlikely to come into the picture especially with the RSI already showing overbought conditions. In this case, attention is likely to shift to defending support at $10.00.

The MACD, on the other hand, clearly shows that BTG is poised for sideways price action. The indicator also features a bullish divergence which highlights that buyers still have substantial influence over the price.