- Bitcoin launched a massive Santa’s rally and settled closes to $28,000.

- The price may retreat to $24,000 as technical indicators send sell signals.

Since Thursday, December 24, Bitcoin smashed several significant levels and hit a new all-time high at $28,922. At the time of writing, BTC is changing hands at $27,750, having gained nearly 12% on a day-to-day basis. All-in-all, Santa’s rally made BTC $3,000 more expensive.

BItcoin’s market capitalization jumped to $515 billion, making the coin more expensive than Visa. According to Asset Dash, now it takes 11th place among the biggest global assets, behind such giants as Facebook, Apple, and Tesla.

Bitcoin’s dominance index surpassed 70% for the first time since March 2017. While the majority of top 100 altcoins have also gained ground following the lead of the pioneer cryptocurrency, they still lag behind, meaning that the so-called altcoin season has not arrived yet.

Bitcoin is vulnerable to correction

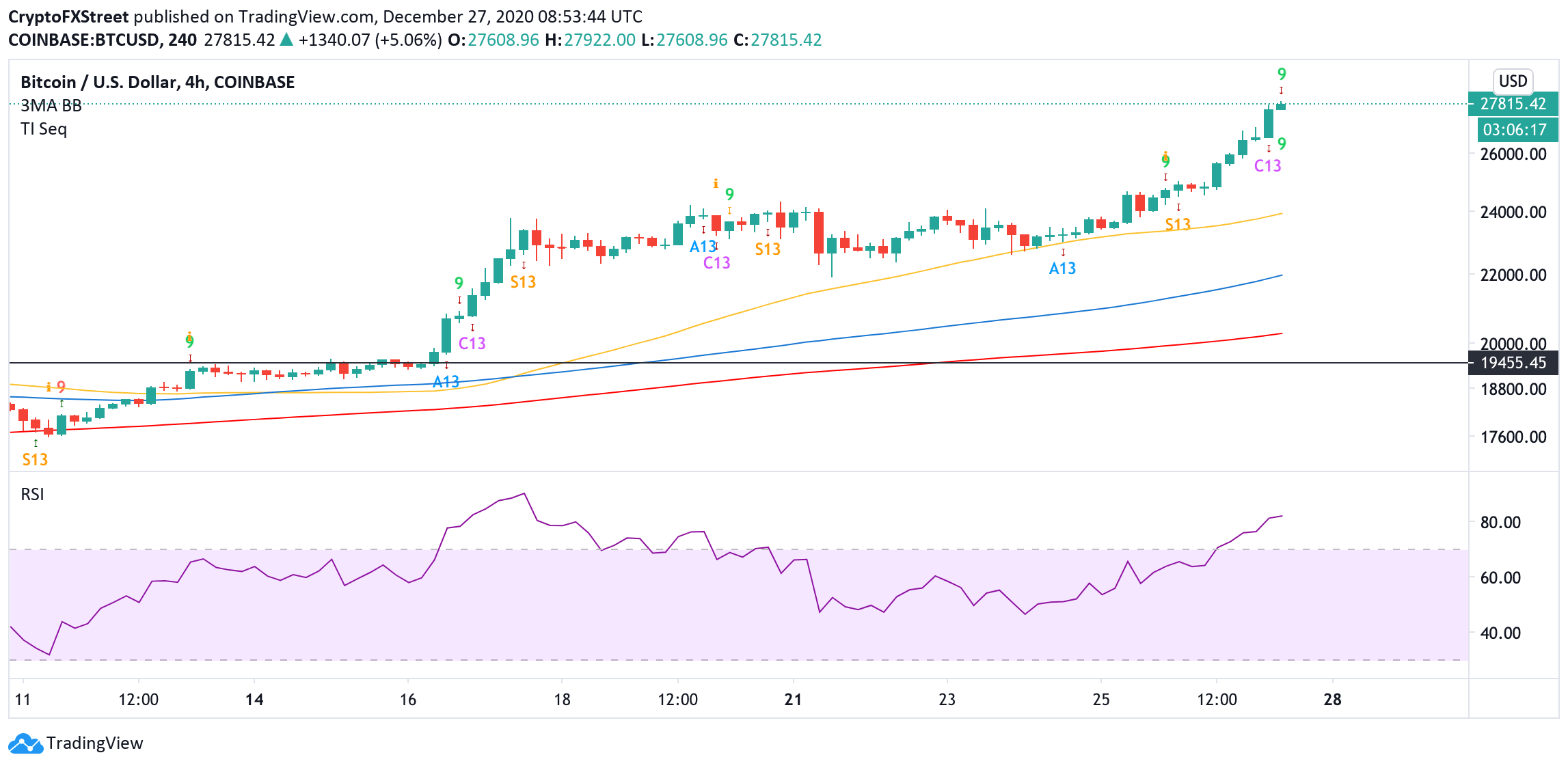

From the technical point of view, Bitcoin is in uncharted territory; however, the technical indicators imply that the coin is overbought and may be vulnerable to short-term retracement. Thus, TD Sequential indicator has presented a sell signal in the form of a green nine candlestick on the 4-hour chart.

BTC, 4-hour chart

If the signal is confirmed, BTC may start a downside correction with the first target at $27,000. Once it is broken, the sell-off may gain traction with the next focus on $25,500. The critical support is created y a combination of a former resistance and the 4-hour SMA50 on approach to $24,000.

The RSI confirms the overbought state of the asset. The indicator reached 81 on the 4-hour chart and started showing signs of the reversal, giving credence to the bearish scenario.

On the other hand, a sustainable move above $28,000 will create another strong bullish impulse and allow for another leg higher before the eventual correction starts.