- Bitcoin price is stuck in a tight range between $7,500 and $8,100 for more than a week.

- Technicals suggest that the indecision will last longer than expected.

BTC/USD trading pair is trending 0.28% higher on the day after correcting from lows of $7,822.11. The intraday chart shows Bitcoin having touched highs at $8,078.74 but reverted back under $8,000 and is trading around $7,940 at the time of writing.

Bitcoin has been stuck in a tight range between $7,500 and $8,100 for more than a week now. A brief surge on Monday from the support at $7,500 climbed above $8,000 but failed to break beyond the resistance at $8,100. Besides, Bitcoin bulls lacked the strength to keep the price above $8,000 opening the way for correction to short-term support at $7,700 on Tuesday.

The ‘father’ of cryptocurrencies commands a 24-hour trading volume of $18 billion. The consolidation. The trading volume has declined significantly from the highs above $30 billion posted during May surge. The largest cryptocurrency has a total market capitalization of $148 billion in comparison to $254 billion for the entire market representing a 55.3% dominance.

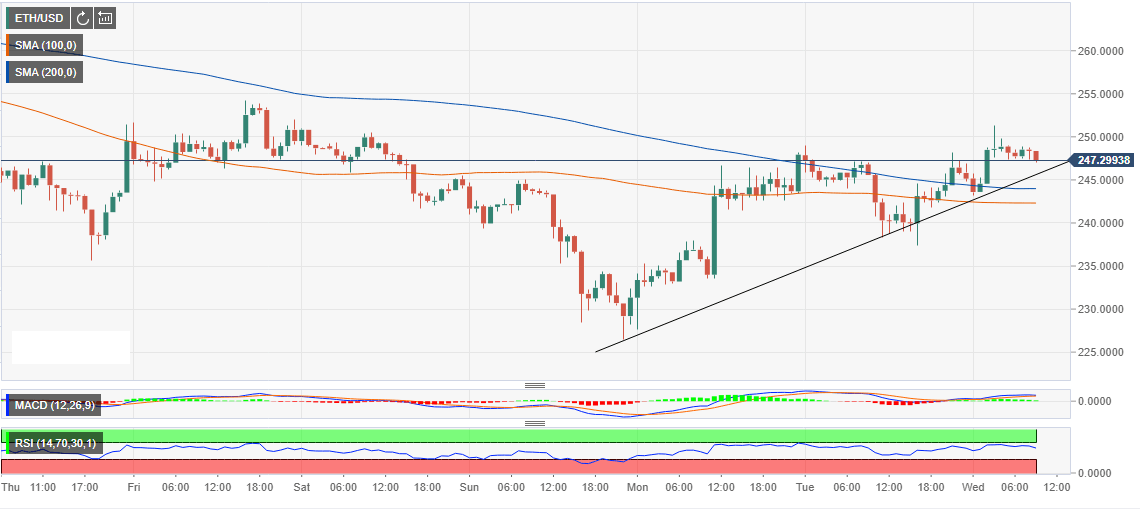

Despite the stalling, Bitcoin is trading above a short-term trendline on the 1-hour chart. Technicals suggest that the indecision will last longer than expected. The RSI is holding position above the average while the MACD is motionless above the mean line. Therefore, we can expect a breakout eventually especially if Bitcoin spikes beyond $8,000 and clears at $8,100 resistance.

BTC/USD 1-hour chart