- BTC/USD extends Wednesday’s recovery moves amid bullish MACD, strong RSI.

- 100-bar SMA, descending trend line from January 08 adds to the upside barrier.

- Multiple supports below $30,000 can test the bears.

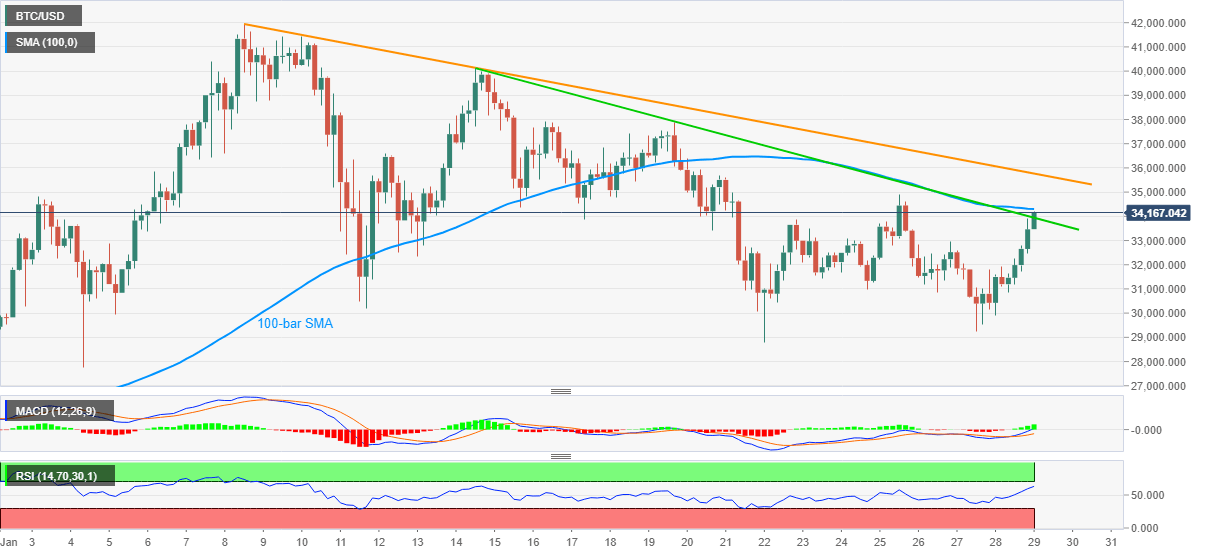

BTC/USD rises to $34,167 while flashing a two-day winning streak during early Friday. The crypto major has been on a recovery move after taking a U-turn from $29,239 on Friday and is currently attacking a short-term resistance line and 100-bar SMA, from January 14.

With the upbeat RSI conditions joining the bullish MACD, BTC/USD is up for crossing the nearby hurdle around mid-$33,900. However, a clear break of 100-bar SMA, at $34,300 now, becomes necessary to convince the buyers. Also acting as the key upside barrier is a three-week-long descending trend line, at $35,770 now.

If at all the BTC/USD bulls cross $35,770, the $40,000 and the record top around $42,000, marked during the early January, should gain the market’s attention.

On the downside, Tuesday’s top near $32,900 can offer immediate support ahead of directing the quote down towards the weekly bottom of $29,239. Though, the $30,000 threshold can act as a buffer during the fall.

In a case where the BTC/USD prices keep declining below $29,239, January 22 low near $28,770 and the monthly bottom close to $27,780-75 can test bears.

Overall, BTC/USD is likely to regain its strength if it manages to cross the near-term key resistances.

BTC/USD four-hour chart

Trend: Further upside expected