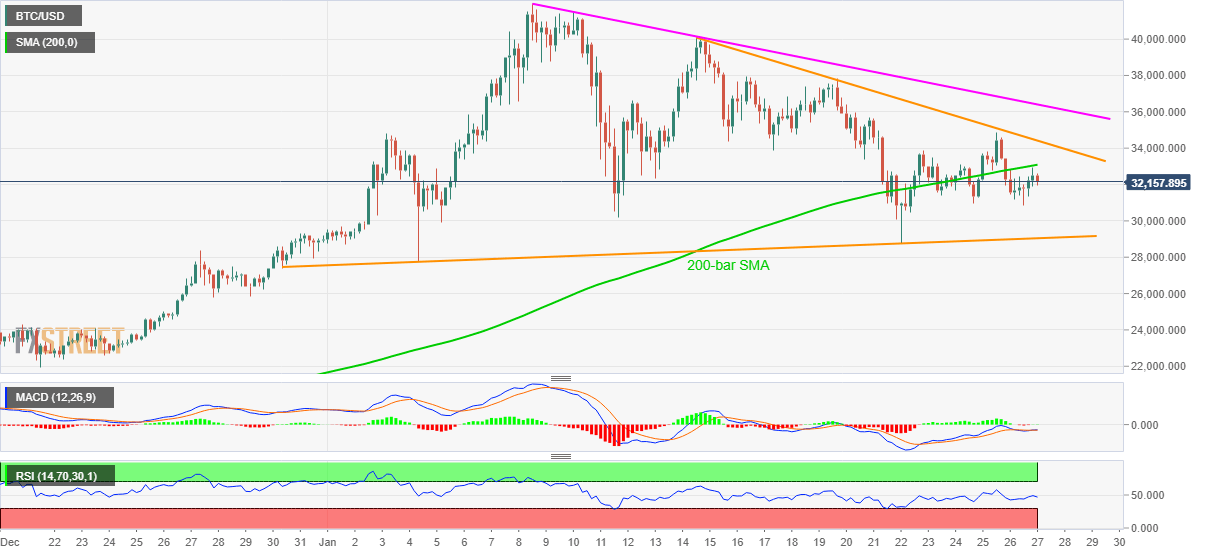

- BTC/USD extends the previous day’s pullback from 200-bar SMA.

- Sluggish MACD, normal RSI favor further consolidation of gains.

- Resistance lines stretched from January 14 and 08 add to the upside filters.

BTC/USD drops to $32,250, down 1.0% intraday, amid the initial trading on Wednesday. In doing so, the crypto major respects Tuesday’s U-turn from 200-bar SMA amid struggling MACD signals and normal RSI conditions. As a result, the quote’s further weakness can’t be ruled out.

During the fall, the weekly low near $30,800 can act as an intermediate halt before highlighting an ascending trend line from December 30, close to the $29,000 round-figure.

It should, however, be noted that Friday’s bottom near $28,770 and the monthly low of $27,777 acts as extra filters to the south for the BTC/USD bears.

Alternatively, an upside clearance of 200-bar SMA, at $33,050 now, will direct the BTC/USD buyers towards a two-week-old resistance line, at $34,420, ahead of challenging the monthly falling trend line resistance, currently around $36,450.

If at all, the BTC/USD bulls manage to cross the $36,450 hurdle, the record top of $41,987 will only be a buffer during the rally towards the $50,000 threshold.

Overall, BTC/USD remains in an uptrend but key short-term resistances offer breathing spaces to the bulls.

BTC/USD four-hour chart

Trend: Pullback expected