- BTC/USD is trading above the trendline amidst a bullish momentum.

- Experts predict Bitcoin will hit $10,000 by the end of 2018.

BTC/USD is seen trending higher above $6,000 on Thursday. This comes after the longest market leader proved right the prediction that it will hit $6,000 level in two months from the beginning of April. In the last six weeks, we have seen Bitcoin increase in value significantly from the levels below $4,000 to trade almost at $6,100.

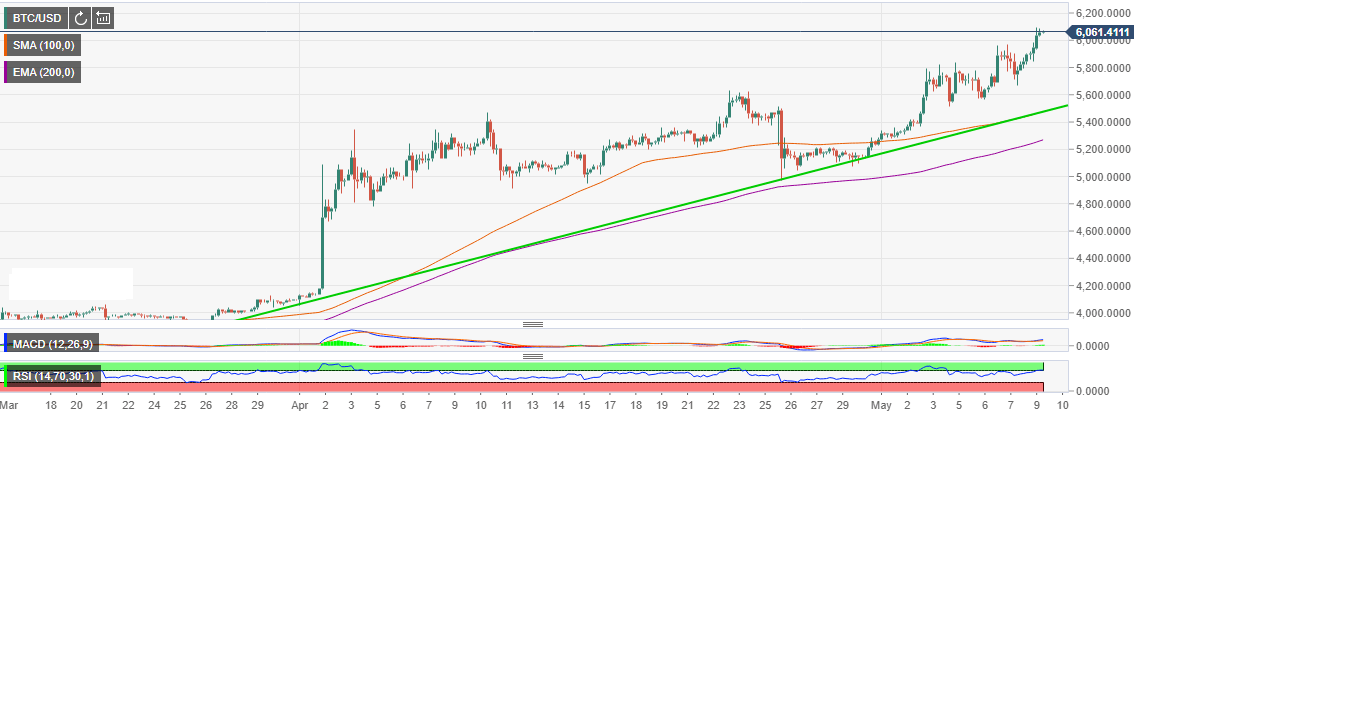

Looking at the 4-hour chart, BTC/USD is trading above the trendline to show that the crypto is a bullish mode. Both April and May have seen the price trade higher highs and higher lows, in addition, to stay above the EMA200 support. As long as Bitcoin stays above this moving average, we will continue to see a correction towards $7,000 in the coming two months. Various experts have predicted that Bitcoin will hit $10,000 by the end of 2018 and the way the status quo is; the asset has the potential of achieving even higher levels.

Bitcoin Price seems to have ignored the hack on Binance exchange. Investors are either not keen or the market is showing higher maturity. As Binance deals with the aftermath of the hack, Bitcoin investors have all the reasons to smile as the asset explores higher levels.

Meanwhile, Bitcoin is trading at $6,060 although it opened the session today at $5,943.15. It has traded highs around $6,097 before correcting lower. The technical levels remain strong amid a building bullish trend. The 100 SMA is still playing catch on the 4-hour chart below $5,400 while the EMA 200 will offer support $5,274.54.

BTC/USD 4-hour chart