- Bitcoin corrected lower breaking several support areas towards $6,200.

- BTC/USD flirts with the 61.8% Fibonacci level; bulls lack momentum for higher retracement.

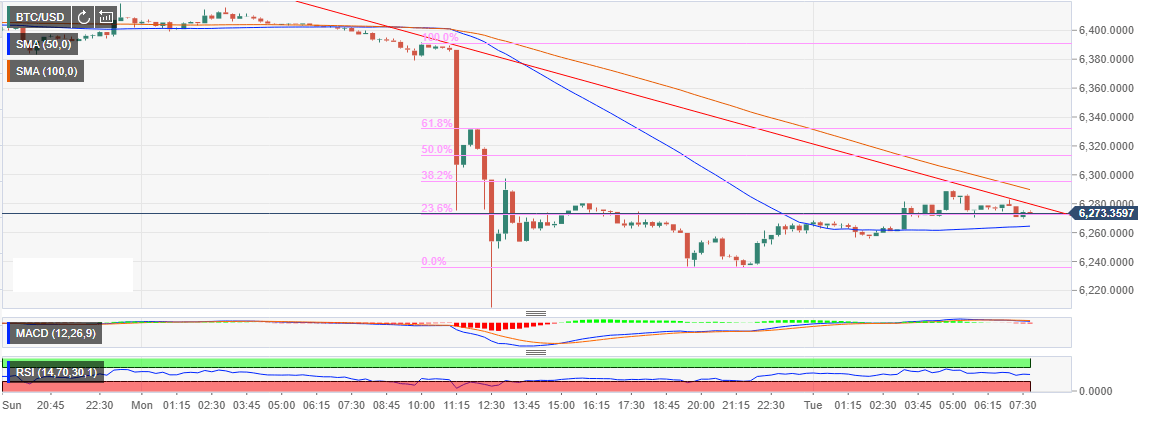

Bitcoin seems to be staging another consolidation phase following the sudden waterfall drop during the trading yesterday. The crypto suffered under the pressure of the bears resulting in slide that broke several support areas at $6,380, $6,370 and $6,300. The next support target at $6,200 held ground strongly stopping further break down.

An upside correction from the support above has seen Bitcoin recoil above $6,280 but the bulls have lost momentum short of $6,290. The price is flirting with the 61.8% Fib retracement level with the last swing high of $6,391 and a low of $6,236.20 at $6,273. The short-term bearish trendline is limiting gains. Besides, BTC/USD is trading between the moving average support and resistance with the 50 SMA offering support at $6,265.27 while the 100 SMA preventing movement to the north at $6,290.18.

The market faintly bullish with Bitcoin having correcting higher 0.11% on the day. The MACD fell to -35 yesterday but has retracted above the mean line. Moreover, the RSI dipped marginally into the oversold region but it has corrected the trend upwards and currently ranging at 54.54%. These indicators show that the market is calm even though the bulls do not possess the power to sustain big movements to the north. A support has been established at $6,260, while the previous support at $6,200 will prevent further breakdown in case the bears increase their grip on the price.

BTC/USD 15′ chart