- BTC/USD loses ground and gets back to $11,000 support.

- A sustainable move above $12,000 is needed to mitigate the bearish pressure.

Thursday’s recovery proved to be short-lived as the first cryptocurrency dropped back towards $11,000 losing over 5% in recent 24 hours. The most popular digital coin touched the intraday low of $10,951 before recovering to $10,151 by press time. Bitcoin’s market share reduced to 62.4% from 63% on Thursday.

Correlation with gold

Bitcoin becomes more correlated with traditional safe-haven assets like gold, Mati Greenspan, the senior market analyst of eToro, points out.

“Even though the correlations are still rather small, it does seem like bitcoin is becoming more integrated with the rest of the financial markets. It seems like bitcoin is finally starting to respond to external factors,” he wrote on his Twitter.

Bitcoin and gold have been moving in close lockstep over the recent month, while the correlation reaches the highest level since 2016, the expert added.

Bitcoin’s technical picture

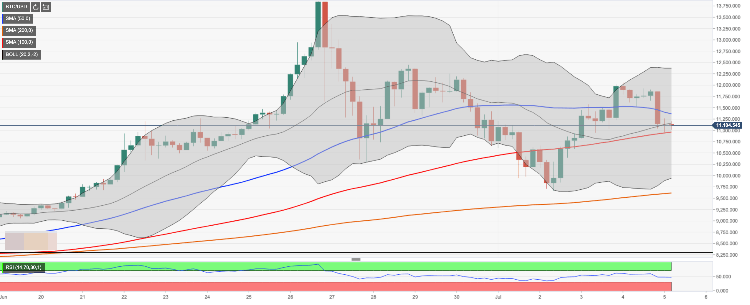

Back to the drawing board! BTC/USD is again at $11,000 while $11,500 serves as the nearest barrier. Once it is cleared, the upside will gain traction with the next focus on psychological $12,00 and $12,350 (the upper boundary of 4-hour Bollinger Band)

On the downside, the initial support comes at $10,96o that encompasses the intraday low and SMA100 (4-hour). A sustainable move below this handle will open up the way towards the next bearish aim of $10,400 with Pivot Point 1-day Support 1 and Pivot Point 1-week Support 1.