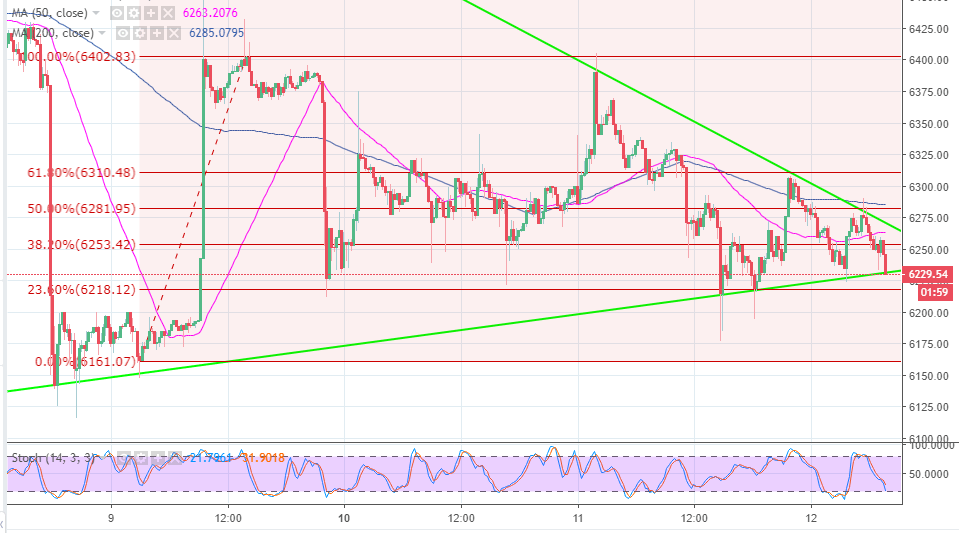

- The contracting triangle is approaching a breakout but hurdles to $6,400 are in plenty.

- Bitcoin is stable above $6,200 but could break down further towards $6,000 if technical are shattered.

Bitcoin is relatively stable in spite of the falling altcoin prices. Moreover, its market dominance continues to rise while altcoins shed off their value. Ethereum has been hit hard in the past weeks dropping from trading above $450 to $170. At the time of press, the market is bleeding, besides most of the top 20 cryptocurrencies are recording losses over 2% on the day.

The previous dip had Bitcoin test $6,120 but the buyers managed to push the price above $6,200. There was a sharp climb to $6,400, although the bulls could not sustain the price at this level. The lower corrections that followed found a support above $6,200 as the buyers battled for more gains.

Bitcoin is, however, range-bound with the lower limit at $6,200 and the upper limit at $6,320. A short-term contracting triangle is also nearing a breakout. Similarly, lower corrections are imminent owing to the fact that technical signals are strongly bearish. The buyers lack the momentum to sustain upward swings while the bears are too charged to give up control.

If the price breaks the triangle support, BTC/USD is likely to test the support at $6,200 and trade near the previous support at $6,120. In addition, further declines could test $6,000 and breakdown to $5,800. On the upside, a break beyond the triangle resistance is likely to open the way to $6,300 (broken support) and the upper supply zone at $6,400 but first, the 50SMA and the 200SMA will limit movement as seen the 15′ timeframe chart.