- Bitcoin defends $5,200 support as technical indicators remain positive.

- BTC/USD is expected to stay in the indecision state in the coming sessions on Monday.

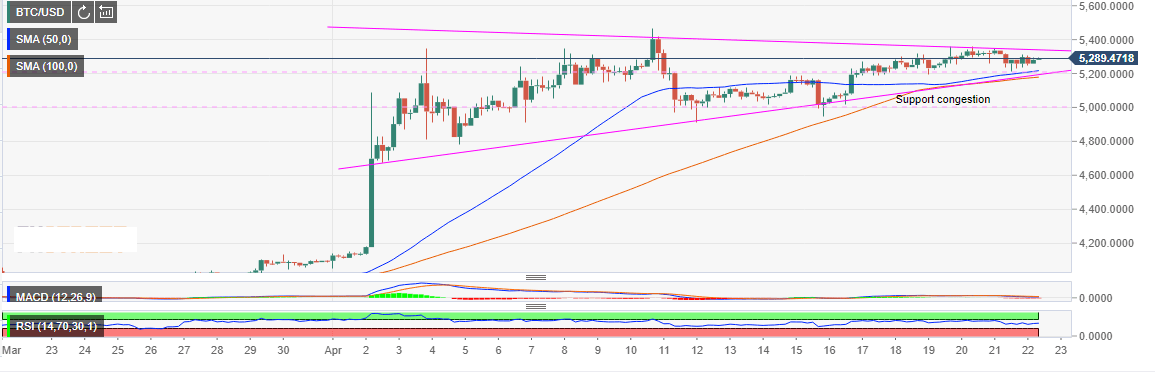

BTC/USD is grinding closer to the rising wedge pattern breakout after defending the support at $5,200. The weekend trading has been more of consolidation with minor upside correction. The upside is limited at $5,300. However, a broader look at the chart, we see BTC/USD in an upward trend above both the 50 simple moving average (SMA) and the 100 SMA 4-hour.

The impending rising wedge pattern breakout could see Bitcoin break down to test the support at $5,000 (support congestion). Last week, Bitcoin tested the zone at $4,900 before resuming the gains. The consolidation above $5,200 could result in a further break down according to the 20-period Bollinger Band.

Meanwhile, the RSI is correcting slightly upwards to show that the bulls still have control. The indicator at 54.16 has been averaging around 50.00 in the last week. The MACD, in the same range, is ranging right at the mean level (0.0). Traders can expect the price to stay in the indecision state in the coming sessions until a break above or below the wedge pattern occurs.

BTC/USD 4-hour