- The number of Bitcoin addresses with unrealized gains decreased significantly.

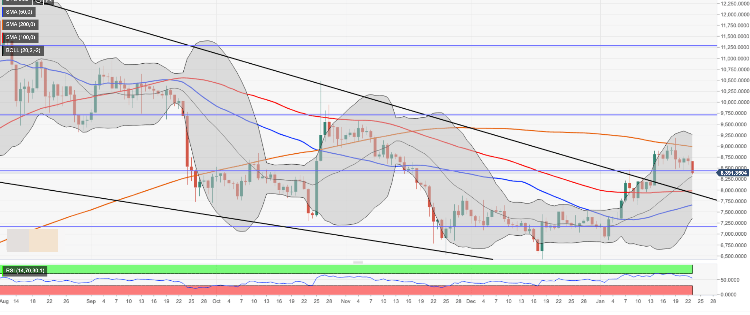

- BTC/USD needs to regain $8,6500 as soon as possible.

Bitcoin (BTC) is under selling pressure on Thursday. The first digital coin has lost over 3.5% since the beginning of the day amid growing bearish sentiments and expanding volatility. At the time of writing, BT/USD is changing hands at $8,350. Bitcoin’s market share has settled at 65.8%.

Notably, the share of Bitcoin addresses “in the money” dropped from 74% on Wednesday to a mere 63% by press time, according to the statistics provided by Intotheblock. The breakeven point for the vast majority of Bitcoins is located around $12,000, which means that an even moderate push towards that area might improve the sentiments significantly. However, considering the recent developments, it seems that we will have to live through another bearish wave before things turn for the better.

BT/USD: technical picture

BTC/USD bears try to take the price below critical support area created by 50% Fibo retracement for the upside move from December 2018 low to July 2019 high. If they are successful enough to engineer a sustainable sell-off below this level, a psychological $8,000 will come into focus. This zone is reinforced by SMA100 daily, and it has the potential to slow down the bears.

On the upside, we will need to see a strong move above $8,650 to mitigate the initial downside pressure and create a pre-condition for a recovery. This area served as a support zone in recent days, which means it may take some time to take it out as resistance. Once it is out of the way, the upside is likely to gain traction with the next focus on $9,000. This is an ultimate short-term target for Bitcoin bulls protected by SMA200 daily.