- Bitcoin market dominance continues to rise in comparison to other digital assets.

- The trend is slightly bullish with the stochastic RSI pointing north while the MACD is still in the positive.

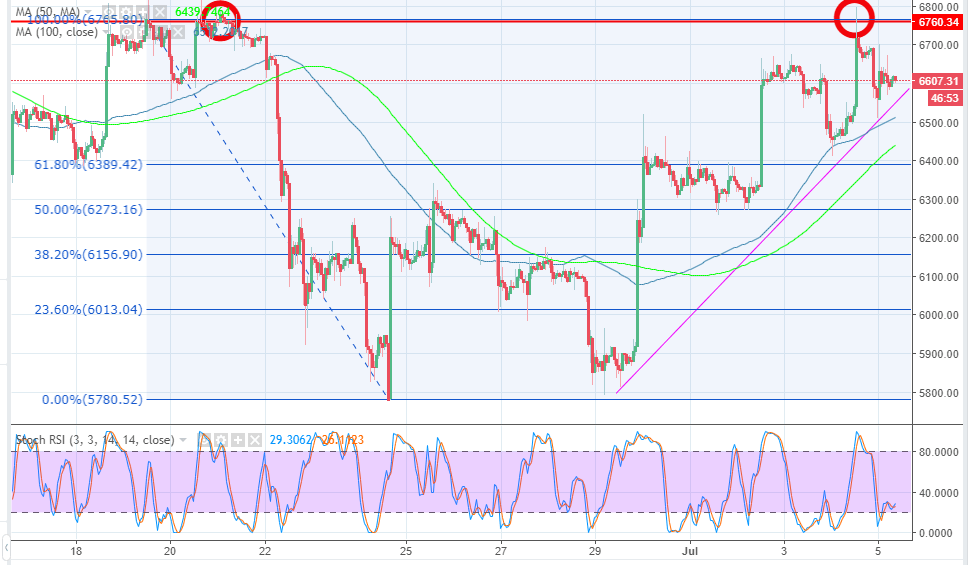

Bitcoin price traded the second top to complete a double-top pattern but ran out of the momentum to sustain the breach above $6,700. The price is trading slightly higher compared to the opening trade on Thursday which means that the trend is still bullish. A short-term support can be observed at $6,600, while the breakout position at $6,700 is still out of the intraday reach for now.

The trading volume for Bitcoin is slightly higher this week compared to last week. However, it has also dropped from $4.6 billion on July 3 to $4.1 billion traded on July 4. Its market capitalization has maintained above $112 billion in the last couple of days. Bitcoin market dominance continues to rise in comparison to other digital assets. It dominates about 41.9% of the entire cryptocurrency market.

Currently, the trend is slightly bullish with the stochastic RSI pointing north while the MACD is still in the positive region but making advances towards the negative region. The moving averages support is provided by the 100 SMA at $6,510 above the short-term support area at $6,500. Moreover, the 50 SMA will also limit declines at $6,440 above the stronger support at the 61.8% Fib retracement level with the previous swing high of $6,765 and a low of $5,777 close to the minor demand zone at $6,400, but the major demand zone is highlighted at $5,900 – $5,800.

BTC/USD 1-hour chart