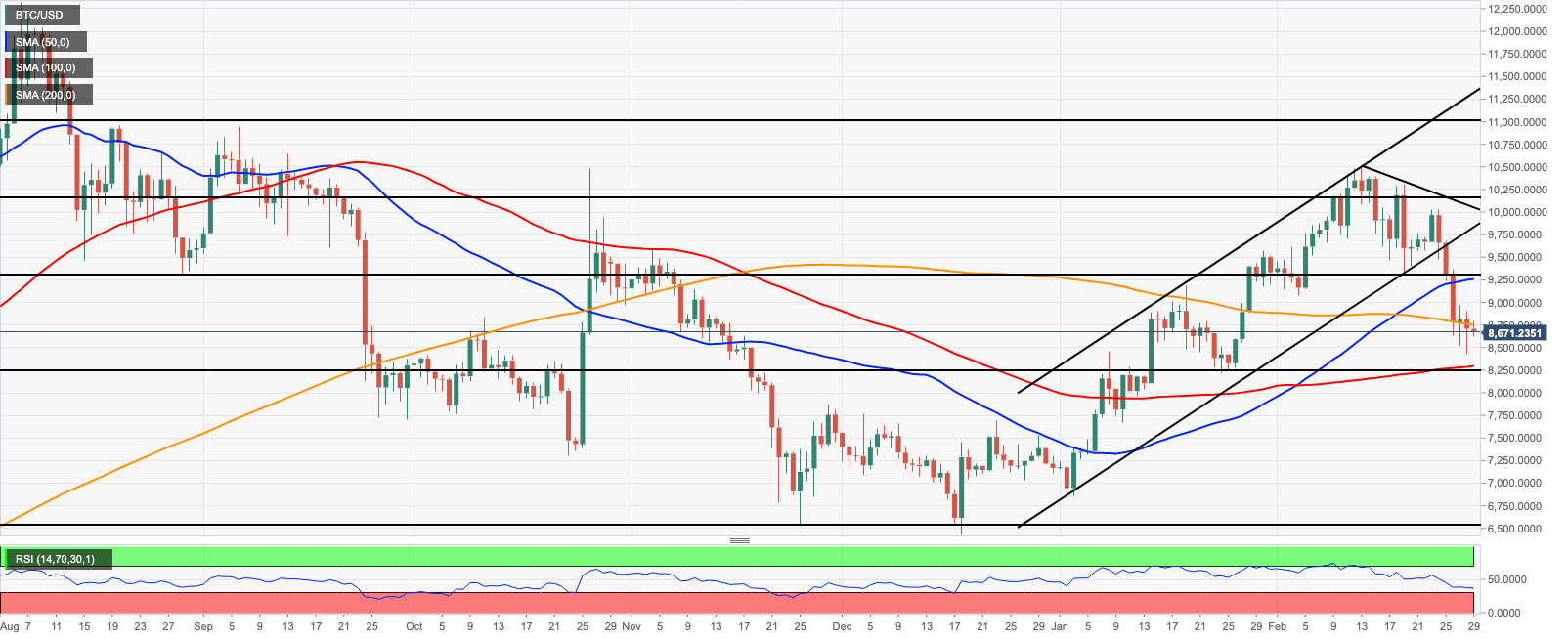

- Bitcoin’s recovery may be limited by $8,800, however, even stronger resistance comes at $9,000.

- The critical support is created by a cluster of buy orders on approach to $8,600.

Bitcoin (BTC) retreated from the intraday high of $8,000 to trade at $8,650 by press time. Despite the sell-off, the first digital asset has stayed mostly unchanged both since the beginning of the day and on a day-to-day basis amid expanding volatility. Bitcoin’s daily trading volume has reached $43.2 billion, while its market share settled at 63.8%.

According to Intotheblock data, about 69% of Bitcoin holders are making money at current price levels. Strong support is created at $8,600 as a large number of addresses having a breakeven point around this level. Once it is broken, the sell-off may gain traction with the next focus on the recent low of $8,431, followed by $8,300. This barrier is supported by SMA100 daily and 38.2% Fibo retracement for the downside move from July 2019 high to December 2019 low.

BTC/USD daily chart

On the upside, a sustainable move above $8,800 is needed to mitigate the immediate bearish pressure. This area is reingofrced by the intraday high and an upper boundary of the intraday consolidation channel. Once it is out of the way, the upside is likely to gain traction with the next focus on psychological $9,000. About 1 million of Bitcoin addresses have a breakeven point around this level, which means BTC bulls may have a hard time taking it out. The next resistance is created by a combination of SMA200 1-hour and SMA50 four hour on approach to $9,300.

-637185774222025476.png)