- Bitcoin slipped under $5,500 amid global cryptocurrency sell-off.

- BTC has been outperforming major altcoins recently.

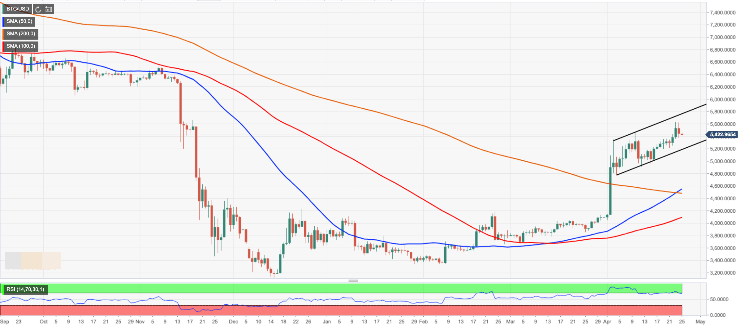

Bitcoin briefly touched $5,641 on April 23, which is the highest level since November 2018. However, gains proved to be unsustainable as the price of the world’s largest cryptocurrency returned to the range under $5,500 handle. While BTC/USD managed to recover from the recent low of $5,378, it is still nearly 2% lower from this time o Wednesday.

Meanwhile, Bitcoin is still positive on a week-on-week basis, while the vast majority of top-20 altcoins (except for Binance Coin) are deep in red. The cryptocurrency experts believe that Bitcoin outperforms the market because it is the most important asset in the digital space.

“When it performs well, the best risk/reward is arguably to own Bitcoin over any other digital asset,” said Jeff Dorman, chief investment officer of an asset manager Arca.

“If you look back to early April, when BTC rose 25% in a day, every other digital asset rose as well. But, since that day, BTC has remained well bid while every other asset has slowly begun to decline due to a rotation out of ‘altcoins’ and into BTC,” he emphasized.

Looking technically, BTC/USD sentiments remain bullish as long as it stays in the upside channel with the lower boundary currently at $5,188. However, we will need to see a return above $5,500 to mitigate the initial bearish pressure and create conditions for the further upside.

The ultimate bullish goal comes at the recent high of $5,641, followed by $5,765 (the upper boundary of the said channel)

BTC/USD, the daily chart