- BTC/USD has retreated from the intraday high amid profit-taking.

- A sustainable move above $12,000 will allow the recovery to gain traction.

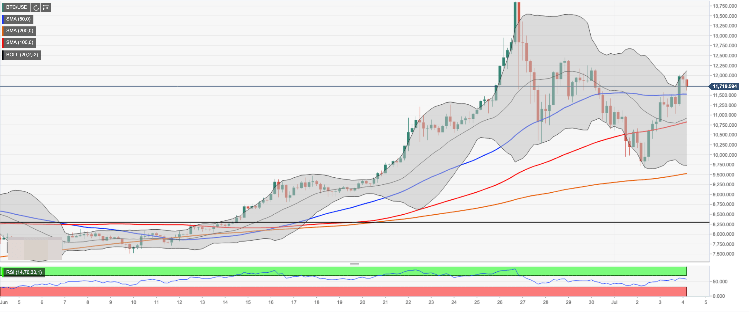

Bitcoin (BTC) has recovered strongly from the recent lows and hit $11.900 during early Asian hours. However, the upside momentum faded away on approach to strong technical levels and caused the profit-taking that pushed the price towards $11,600 by press-time. BTC/USD has gained 2.4% since this time on Wednesday and lost 2.2% during the Asian trading on Thursday.

Looking technically, a sustainable move above $11,500 barrier allows for an extended recover towards $12,000 and $12,100. This barrier is strengthened by a confluence of strong technical indicators including the upper boundary of Bollinger Bands on both 4-hour and 1-hour charts.

Once it is cleared, the upside is likely to gain traction towards $12,500 strengthened by 38.2% Fibo retracement for the downside move on a weekly basis. An ultimate resistance awaits on approach to $13,000 with the upper line of 1-day Bollinger Band.

On the downside, the initial support comes at $11,500 created by SMA50 4-hour chart. A sustainable move below this handle will open up the way towards the next bearish aim of psychological $11,000 and $10,800 (middle line of 4-hour Bollinger Band and SMA100 4-hour chart). A move below this area will encourage the bears to push the price towards $10.700 (the middle line of 1-day Bollinger Band). This area will slow down the sell-off and attract new buyers.