- The hostility towards the bulls did not stop until Bitcoin dived under $9,500.

- Analysts remain strongly bearish with Bitcoin staring into the abyss.

- Indicators are strongly bearish and still flashing sell signals.

Several analysts were strongly bearish last week despite Bitcoin managing to stay above $10,000. CNBC’s Brian Kelly was particularly not convinced that Bitcoin’s price leg towards $11,000 was going to hold. Kelly shocked many with his bearish sentiments towards Bitcoin.

However, it is barely a week and Bitcoin is back where it started a couple of weeks ago. The failed attempt to complete the leg above $10,700 must-have demoralized the bulls and left them helpless. They used up all the fight they had left to defend $10,000 in the past two days. However, the rising selling activity due to the energized spirit of the bears sent Bitcoin spiraling below $10,000.

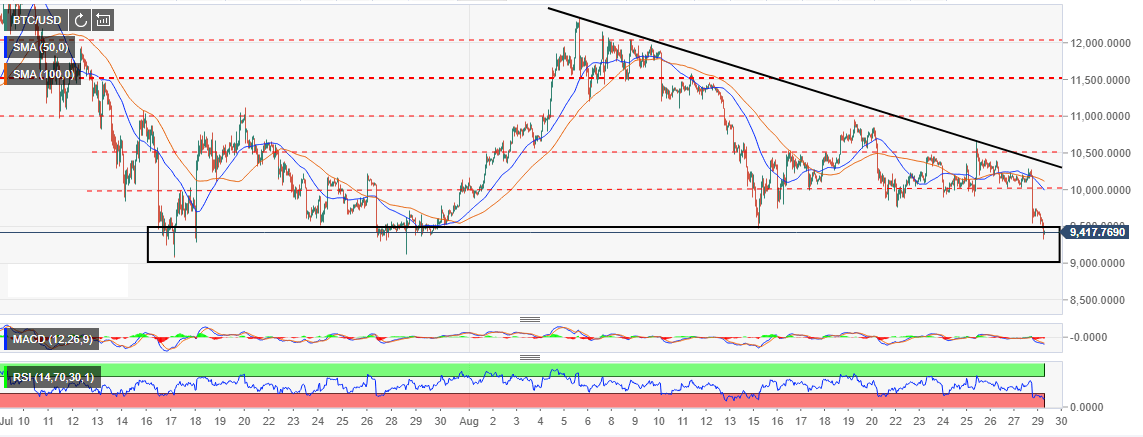

Unfortunately, the hostility towards the bulls did not stop until Bitcoin dived under $9,500. At press time, the cryptos granddaddy is hovering at $9,430. There has been a shallow recovery from the weekly low at $9,328. However, the upside remains capped at $9,500 support turned resistance.

Indicators are strongly bearish and still flashing sell signals. The Relative Strength Indicators is buried deep in the oversold. The divergence with the Moving Average Convergence Divergence (MACD) suggests that the bears’ dominance will stay a while longer. On the Contrary, the RSI being in the oversold could mean that Bitcoin is oversold and a reversal although delayed is in the offing.

BTC/USD 1-hour chart