- “They could make central bank money user-friendly in the digital world by issuing digital tokens of their own…” wrote Dong He.

- Bitcoin price short-term target on the upside is at $7,600 which is a breakout position towards $7,700.

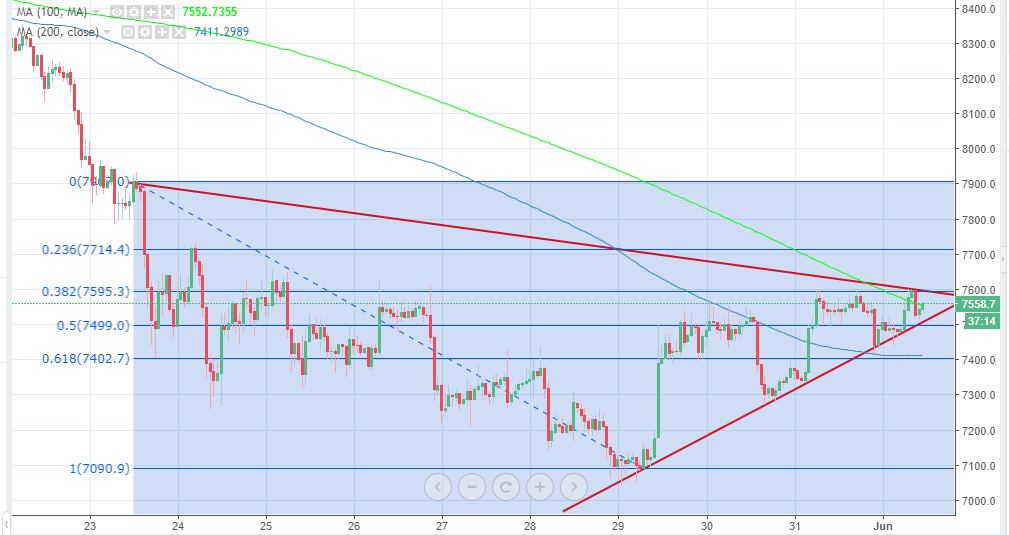

The week’s trading is coming to an end and it seems Bitcoin will close the trading on June 1 below $7,600. There is a bullish momentum in progress but the upside is being limited by the upper trendline of the contracting triangle pattern. The trendline also coincides with the 38.2% Fib retracement level with previous swing high of $7,907 and a low of $7,090.

The International Monetary Fund (IMF) has been one of the crypto-progressive financial institutions lately. The Director of Monetary and Capital Markets Department, Dong He, in his latest report wrote in plain sight about the skepticism of the central banks across the world towards digital assets. He believes that the monopolistic nature of central banks was the catalyst for the creation of Bitcoin. Moreover, Mr. He says that central banks will in future become obsolete institutions due to virtual currencies. A section of Dong He report reads:

“Central banks should continue to make their money attractive for use as a settlement vehicle. For example, they could make central bank money user-friendly in the digital world by issuing digital tokens of their own to supplement physical cash and bank reserves. Such central bank digital currency could be exchanged, peer to peer in a decentralized manner, much as crypto assets are.”

Bitcoin price, on the other hand, is trading at $7,558 at the time of writing and is battling to overcome the short-term resistance at $7,560. The 50 SMA is providing immediate support, besides, the contracting triangle is supported at the 50% Fib retracement level. The short-term target on the upside is at $7,600 which is a breakout position towards $7,700. On the flip side, if the support zones above fail to hold the price, the 200 SMA presents a demand zone slightly above $7,400, however, $7,300 is still within reach.

BTC/USD 1-hour chart