- Bitcoin stays below critical $3,200 handle.

- Technical factors imply that the bottom is not reached yet.

Bitcoin set a new 2018 low on weekend. The first digital coin touched $3,126 briefly before recovering towards $3,196 by the time of writing. The overall market sentiments remain bearish on Monday Though BTC/USD is mostly unchanged since this time on Sunday and since the beginning of the day.

Bitcoin’s intraday technical picture

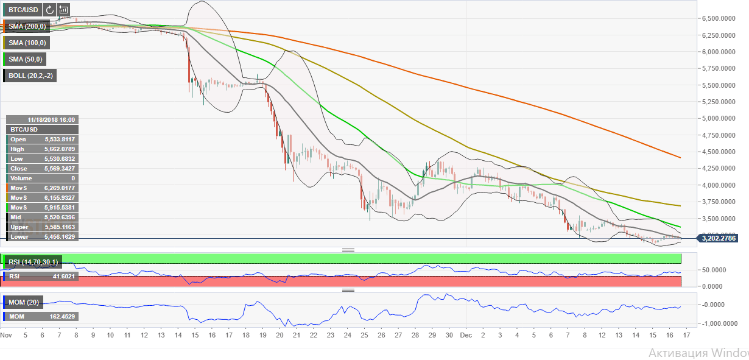

For the first time ever BTC/USD dropped under weekly SMA200 (currently at $3,200) and stayed there. This is very unhappy development from the technical point of view as it implies more selling , in the long run, is the price sails to recover in the nearest future.

From the shorter-term perspective, BTC/USD is also capped by $3,200, strengthened by a combination of technical factors, including Bollinger Band 4-hour Mid-line, previous week low, and the broken support level. A sustainable movement higher is needed to mitigate immediate bearish pressure and allow for a solid recovery with the first aim at $3,378 (upper line of the Bollinger Band) and $3,300. This is another psychological hurdle that is likely to stop the recovery for the time being.

On the downside, the first support is created by $3,144 (lower line of Bollinger Band, 4-hour). Once below, the sell-off may be extended towards the recent low at $3,126 and $3,100. The next critical support comes at $3,000, which is unlikely to be broken at the first attempt.

The Relative Strength Index stays close to the oversold territory. It points downwards, which implies that bears are still in control.

BTC/USD, 4-hour chart