- Extended declines will be stopped at $6,600 – $6,500; the 61.8% Fibo will also hold ground at $6,400.

- The report shows that the Chinese Yuan currency is utilized in less than 1% of all crypto-trades.

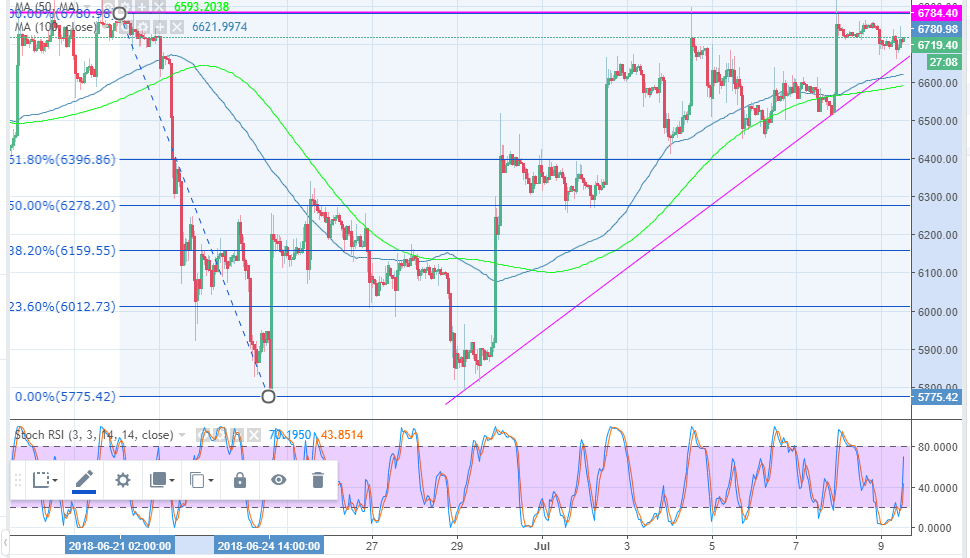

Bitcoin price has been limited below the resistance at $6,800 since the decline that had it drop from trading above $7,000 in June. The Bulls have managed to recoil the price from changing hands below $6,600, but they lack enough momentum for further upside corrections back above $7,000 (critical resistance zone). At the moment, BTC/USD is battling to consolidate above $6,700, although it is still limited at the narrow end of the rising wedge pattern.

If the buyers can gather momentum to push for higher corrections past the short-term resistance at $6,800, BTC/USD could gain momentum towards the coveted $7,000. In the meantime, a support above $6,700 is good enough. The 100 SMA on the 1-hour chart is still positioned to offer support above $6,600. Extended declines will be stopped at $6,600 – $6,500. Furthermore, the 61.8% Fibo will also hold ground at $6,400.

In the latest report published by Chinese state media, the Central Bank of China is very contended with the current status of cryptocurrency ban in the country. The report shows that the Chinese Yuan currency is utilized in less than 1% of all crypto-trades. China banned the trading of cryptocurrencies along with Initial Coin Offering in September 2017. The crackdown on virtual currency activities has continued since then. An industry analyst at the Zhongchao Credit Card Industry Development Company, Zhang Yifeng commented on the new data from the central bank saying:

“The timely moves by regulators have effectively fended off the impact of sharp ups and downs in virtual currency prices and led the global regulatory trend,”

Guo Dazhi, a research director at Zhongguancun Internet Finance Institute also commented on the effect of the ban on cryptocurrencies. He said:

“This indicates that the policy has been very successful. It is within expectations that the yuan’s share in global Bitcoin transactions would drop after China announced the ban.”

Read more on Bitcoin price analysis

BTC/USD 1-hour chart