- Major cryptocurrencies swim in bloody waters as Bitcoin butchers several lifesaving support areas.

- Bitcoin is establishing a support at $6,200 while the next resistance target is at $6,250.

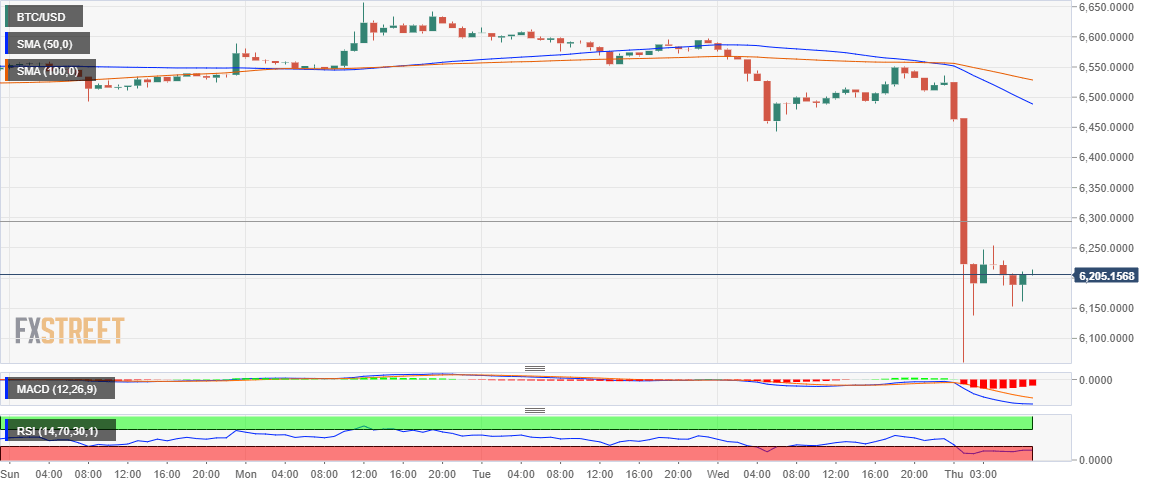

Bitcoin (BTC) has disappointed the investors who have been anxiously waiting for a breakout. The crypto was in a consolidation stated for a period of at least two weeks. However, the king of cryptocurrency tumbled moments following the opening of the session on Thursday. The Asian trading hours have seen Bitcoin drop massively in half an hour butchering several support areas only to find bearing above $6,000.

At press time Bitcoin is down more than 4% on the day after trading lows of $6,060. The European trading hours have seen BTC/USD made a slight comeback above $6,200. Bitcoin is trading at

Generally, the bears are still in control, besides the MACD is deep in the negative territory. Moreover, the Relative Strength Index (RSI) has been stuck in the oversold region since the opening of the trading session today. Bitcoin price is also below the Moving Averages which will offer resistance during the retracement at $6,488 and $6,530.

Looking at the chart, we see that Bitcoin buyers have the power to defend the $6,200 support while a recoil to $6,300 and beyond must clear the resistance at $6,250. On the flipside, a short-term support is currently highlighted at $6,150 while $6,100 and $6,000 will come in handy in case the bears bite at the bulls again.

BTC/USD 1-hour chart