- The bloody market is steadily turning green again with Bitcoin keeping above $3,800.

- A building bullish momentum is likely to break above the 23.6% Fib level resistance.

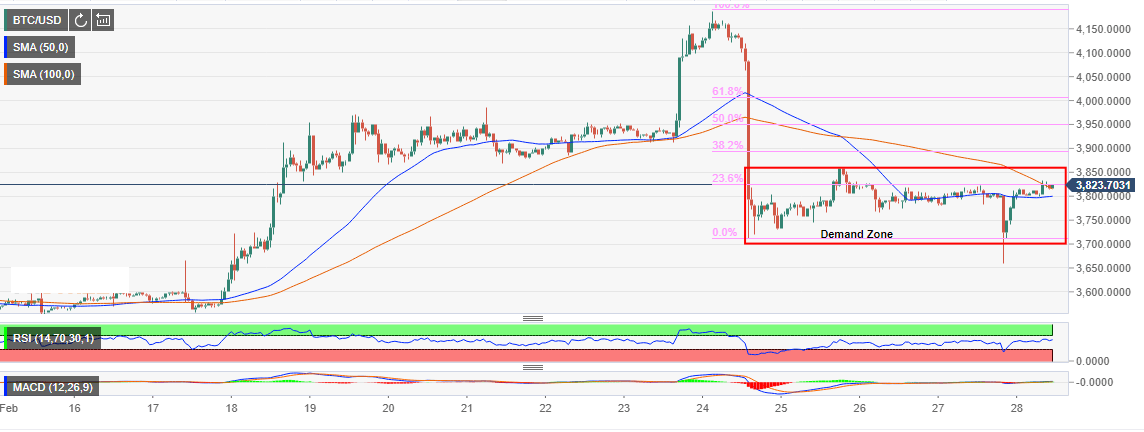

The crypto market is currently calm following the storm on Sunday week. Bitcoin plunged from the highs recorded in February around $4,187. The asset was unstoppable at $4,000 igniting further breakdown towards the demand zone at $3,700. The bloody market is steadily turning green again. Similarly, in the last few days, Bitcoin has been pivotal at $3,800 while the recovery hit a snag at $3,861 on Monday 25.

The payments network Square founded by the CEO of Twitter, Jack Dorsey is reported to have recorded the highest Bitcoin revenue in the last quarter of 2018. Square made a record $166 million in revenue from the sales of the largest cryptocurrency on the market. The report was filed on Wednesday with the Securities and Exchange Commission (SEC). Details show that the firm made $3.3 billion in revenue in 2018. Bitcoin Sales contributed $166,517,00 but the cost of buying the Bitcoin was $165 million. Which means Square made about $1.69 million in net profit.

While Square was breaking the record in terms of revenue, Bitcoin itself was in a downtrend the entire 2018. The asset traded lows of $3,146 before the recovery in December came in the rescue of BTC investors. However, Bitcoin has not been able to come out of the core support zone between $3,000 and $5,000 in spite of gains. The rise last week saw it break above $4,000 but plunged back to the levels above $3,700.

At press time, Bitcoin is trading at $3,823 following a subtle 0.67% correction on the day. The Relative Strength Index (RSI) 1-hour chart trending towards the overbought from the levels around 24. Bitcoin price is immediately supported by the 100-day Simple Moving Average (SMA). A building bullish momentum is likely to break above the 23.6% Fib level resistance and possibly extend the gains above $3,900 and the critical area at $4,000.

BTC/USD 1-hour chart