- Bitcoin price shows a sluggish price action as it trades just above $47,000.

- El Salvador legislative assembly approve $150 million to set up a Bitcoin trust.

- The $51,000 level crucial to BTC making a bullish breakout to record new highs.

The Bitcoin price started this week in market consolidation, perhaps with profit-taking dominating the marker after the impressive gains witnessed following the July 21 rally. BTC has been trading between August 23 three-week high at $50,482 to yesterday’s intraweek low at $46,480. This represents an 8% difference between the two swing points. At the time of writing, Bitcoin is trading at $47,313 as seen on the four-hour chart.

Despite the frustratingly sideways price action for Bitcoin bulls, there are highly encouraging fundamentals and on-chain metrics that are likely to increase investor appetite and may be lift BTC back to the $50,000 mark.

El Salvador Parliament Approves $150M Bitcoin Trust

On top of the fundamental’s this week is that the El Salvador’s legislative assembly ha approved a $150 million dollar Bitcoin Trust aimed at supporting the development of crypto infrastructure and services across the country. This comes ahead of the country’s Bitcoin law which is set to take effect with the next seven days.

This fund will support the $23.3 plan to install crypto ATMS across the country and $30 million incentives in form of a $30 to every citizen who signs up for the state-backed crypto wallet – Chivo.

The bill creatin the trust was passed yesterday August 31 with 64 legislators supporting it and 14 voting against it. It is expected that the Trust will facility efficient conversion of Bitcoin into US dollars (USD). The Trust is also meant to support the development of crucial technological infrastructure aimed at enabling widespread adoption of cryptocurrencies around the country.

The congressional document seen by Yahoo Finance news team read:

“The purpose of this law is to financially support the alternatives that the state provides, without prejudice to private initiatives, that allow the user to carry out the automatic and instantaneous convertibility of bitcoin to the United States dollar.”

The $150 million to be used to set up the Bitcoin Trust will be redirected from the $500 million the country received from the Central American Bank for Economic Integration (CABEI). The loan was originally meant to steer economic recovery for small and medium sized businesses.

The Central American country has been using USD as legal tender and becomes the first in the world to use the cryptocurrency as legal tender.

However, as the new Bitcoin law effects soon, it has been widely criticised from across the country with some citizens believing that it would facilitate corruption in the country known for lack of transparency in its policies.

The $51,000 Mark Is A Crucial Level For The Bitcoin Price

Bitcoin price bulls appear to be overpowered by the bears while some altcoins are soaring. The flagship cryptocurrency has lost crucial support at the $48,000 psychological level and could drop further towards the 200 period Simple Moving Average (SMA) at $45,275.

The four-hour chart shows that Bitcoin is spelling out descending triangle as indecision dominates the market. Currently, BTC is hovering around the descending line of the chart pattern as it battles resistance at this level.

At the time of writing, Bitcoin is exchanging hands at $47,313 on most crypto exchanges and appears to be battling immediate resistance from the down-sloping trendline of the chart pattern.

Should bulls buyers fail to overcome this resistance and close the session below $47,000 psychological level, BTC might slide to close the day below the horizontal boundary of the triangle at $46,480. If this happens, the bellwether cryptocurrency may fall towards the 200-SMA at $45,275.

BTC/USD Chart

To reverse this pessimistic outlook, Bitcoin price would need to break out of the sluggish price action and surge above the immediate resistance at $47,468 where the 100 SMA coincides with the descending line of the triangle.

Increased bullish momentum may bolster BTC to overcome the nest major resistance at $48,1100 embraced by the 50 SMA before rallying to tag the tip of the $50,000 mark.

Note that a decisive bullish breakout will be achieved once Bitcoin break out above the current upper tip of the triangle’s descending trendline currently embraced by the $51,000 level.

According to analysist, turning this level into support is a “deal-breaker” for BTC.

Cointelegraph crypto analysts Michaël van de Poppe is clear on the opinion that Bitcoin needs to break through the $51,000 to re-start the uptrend towards $58,000 levels. In a video posted on YouTube van de Poppe said:

“If that happens, we most likely are going into a new impulse wave back to $58,000 at first and then probably a new all-time high.”

Note that BTC is $17,000 away from the all-time high at the time of writing. Therefore, significant buyer support would be needed to make sure that Bitcoin exits the current trading zone.

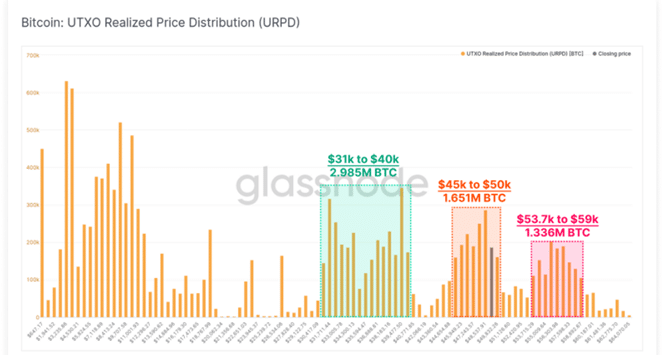

On-chain metric from Glassnode indicate that this support is can be found from buyers between the $45,000 and $50,000 price range. In their latest weekly report published on August 30, Glassnode analytics show that 1.65 million BTC have a cost basis within this price range.

This implies that there is still a fairly strong set of highly convinced investors in market which is a powerful bullish crypto signal.

How to Buy BTC

You can buy Bitcoin on top exchanges such as: eToro, FTX, Binance and Coinbase. You can find others listed in our crypto trading platforms guide.

Looking to buy or trade crypto now? Invest at eToro!

Capital at risk