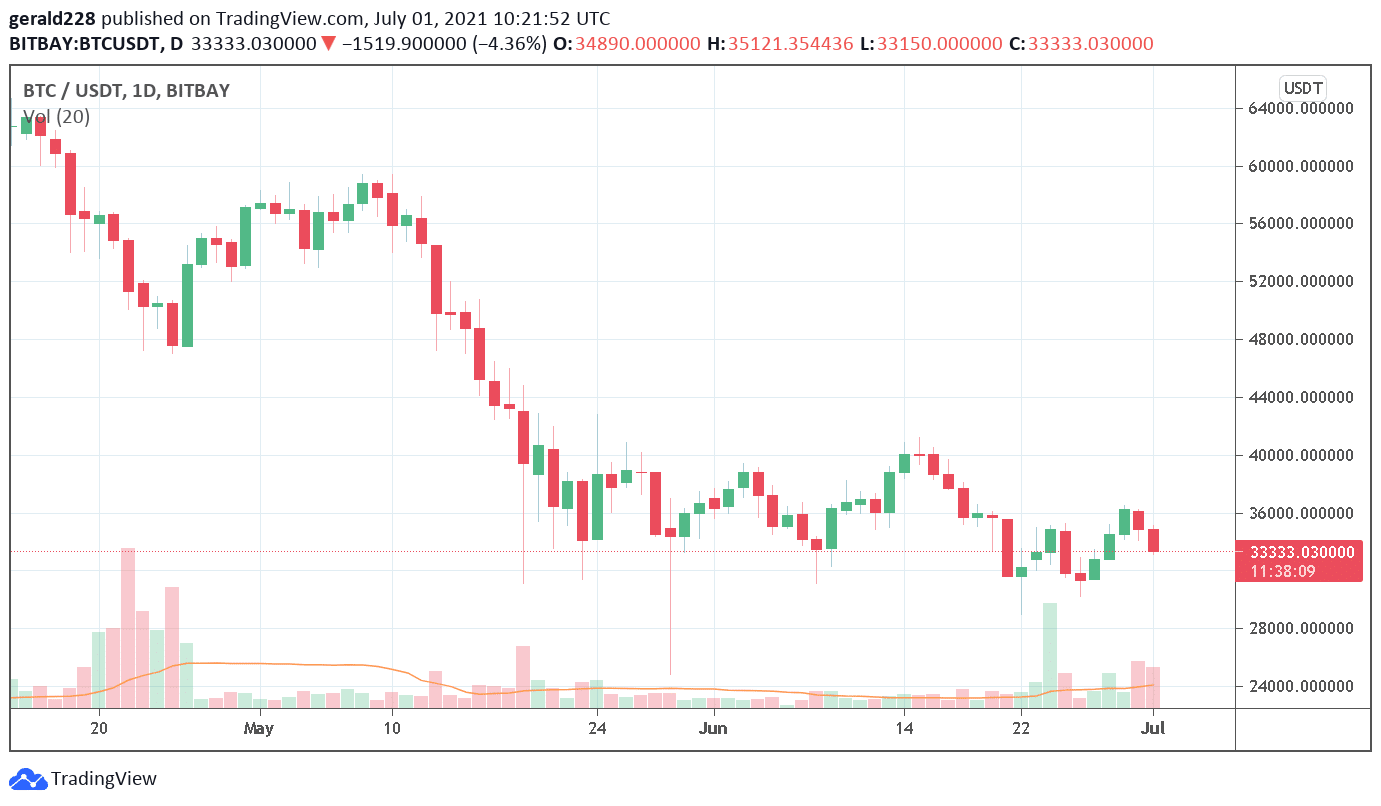

The Bitcoin price seems to have been stuck in a mire of late after having begun its big descent from the $65K mark in early May. It briefly flirted with the $30k mark in June and even fell below that level for a while. Bitcoin is currently trading at the $33,600 level after having succumbed to slight bearish pressure but appears to be well supported at this level.

The Bitcoin price actually touched the $36000 mark on 30 June but is now down to the $33,500 level or a decline of 4% over a 24-hour period. Factors that could have affected this sudden dip include the continued fallout from the Binance FUD and the relative uncertainty over China’s continued crypto crackdown.

South African Scam May Have Renewed Bearish Sentiment

Yet another scam involving Bitcoin has sent the warning bells ringing over fraud, this time in South Africa. Africrypt, which is a company launched in 2019 by two South African brothers has gone south with an alleged $3.6 billion vanishing. The South African financial regulator has indicated that it will introduce regulation but the goose has been cooked for investors it seems.

Africrypt promised returns of five times the investment amount but it transpired that only $126K were invested. Legal sources who are assisting the unfortunate investors confirmed the $3.6 billion amount which vanished. This FUD could be behind BTC’s sudden drop to $33K.

Short Term Prediction For Bitcoin Price: Elusive at $36,000

It appears that the $36,000 level is becoming rather elusive for Bitcoin. Although bullish sentiment pushed the price up to just under this level on 30 June, there was a swift retracement back to below $35k. Today the price fell further to the $$33,200 level on the back of the South African news and other FUD so there is currently an grey area for further positive movements in the price.

The rebound from $30,000 that happened last week was yet another reminder of how crucial this level is the future of the BTC price. Institutional investors undoubtedly accumulated large amounts of BTC at that price and made a quick 20% profit if they sold yesterday – just 7 days after the crash. There was some participation from retail investors, but it is the big boys who can ignite large price swings.

The fact that there seems to be considerable support at the $30,000 level demonstrates a foundation to support negative news such as the decision by the UK Financial Conduct Authority on Binance.

There is still some bullish sentiment for Bitcoin and the next level of resistance after a rebound could be the $37,600 mark or the 50 day SMA. The price could then rally and reach the $42,500 mark which represents a gain of around 25% from the current price.

Looking to buy or trade crypto now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.