- Bitcoin dips under $8,000 after failing to clear the resistance at $8,800.

- A shortage of viable support levels puts Bitcoin at risk of plunging towards $7,000.

For the first time in Bitcoin is back to trading under the critical $8,000. The failure to break above $8,400 this week must have left the buyers demoralized. I’d like to assume that the drop under $8,000 is necessary to create demand for Bitcoin towards the end of this week.

Bitcoin is trading at $7,952 after correcting lower 0.57% on the day. The prevailing trend is strongly bearish despite the low volatility being witnessed. Bitcoin has a market capitalization of $144 billion and a trading volume in the 24 hours of $15 billion.

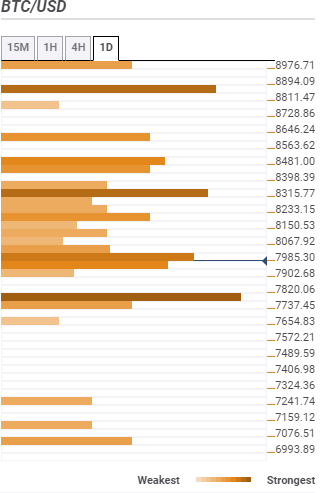

Bitcoin confluence levels

According to the confluence detector tool the immediate resistance that Bitcoin bulls are forced to deal with is $7,985. A cluster of indicators calls this zone home including the Bollinger Band 15-minutes lower, previous high 15-mins, previous low four-hour, the Simple Moving Average Convergence (SMA) five one-hour, BB 15-mins middle and the previous high one-hour among others.

In the event a correction above $8,00 comes into play, buyers should brace themselves to tackle to the hurdle at $8,315 highlighted by the SMA 200 one-hour, SMA 50 four-hour and Fibonacci 161.8% one-day. Further movement towards $9,000 must clear the strong resistance at $8,894.

On the downside, there is a shortage of support areas with $7,820 being the only visible significant support zone. The level is home several indicators including the pivot pint one week support one, pivot point one-day support two and the previous week low.

More confluence levels