- Bitcoin has gained more than 1,200% in value after the pandemic-triggered crash in March 2020.

- The network has witnessed consistent growth in the number of active addresses over the past year.

- Declines toward $50,000 will come into the picture if Bitcoin slices through $54,000.

Bitcoin has rallied over 1,200% since the pandemic-triggered Black Thursday day crash in March 2020. The flagship cryptocurrency traded a yearly low at $4,130 following a massive drop from $8,000. The period has yielded tremendously, with Bitcoin hitting a record high above $58,000. Meanwhile, the bellwether cryptocurrency is looking forward to setting another all-time high above $60,000 amid calls for an upswing beyond $100,000 at the end of 2021.

Bitcoin grows in tandem with network utility

The bull run has brought a lot of attention to Bitcoin, with traditional investment companies and key global figures entering the digital industry. MicroStrategy currently has more than $5 billion of its assets invested in Bitcoin, while Tesla added $1.5 billion to its balance sheet.

The persistent rally appears to have been supported by the increasing network utility. On-chain data by Santiment shows a huge uptick in the number of daily active addresses. This long-term growth is a clear signal for an up-trending market.

Bitcoin active addresses

Bitcoin’s uptrend steadies toward $60,000

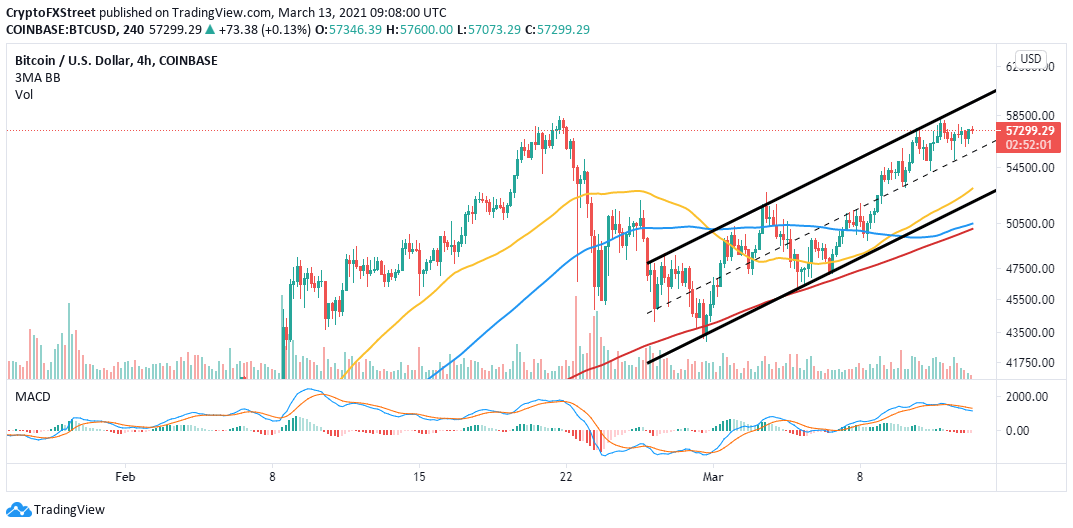

Bitcoin has sustained an uptrend within the confines of an ascending parallel channel. The middle boundary of the channel has, over the last few days, functioned as a critical support level. Meanwhile, Bitcoin is doddering at $57,400 amid the persistent push for gains above $58,000.

Note that a sustained price action above $58,000 will bring Bitcoin out of the woods and set it on a path to new all-time highs. The gap formed by the 50 Simple Moving Average above all the other moving averages (200 SMA and 100 SMA) shows that BTC is in the bull’s hands.

BTC/USD 4-hour chart

Looking at the other side of the fence

Bitcoin will abandon the breakout to new all-time highs if the resistance at $58,000 remains intact. Overhead pressure will begin to rise, perhaps enough to slide the price under the channel’s middle boundary. Support at $54,000 is crucial to the uptrend; therefore, if lost, massive declines will be triggered toward $50,000.

%20%5B12.06.29,%2013%20Mar,%202021%5D-637512260200724980.png)