- BTC/USD is range-bound after a sharp sell-off during late Wednesday hours.

- The downside pressure is set to increase on a breakthrough below $7,500.

Bitcoin consolidates losses marginally above $7,600 handle after a sharp sell-off during late Wednesday trading. The first digital coin is vulnerable to further losses as bearish sentiments dominate the market. Binance technical issues might have served as a trigger for a sell-off, while a sustainable move below critical $7,800 sped up the movement.

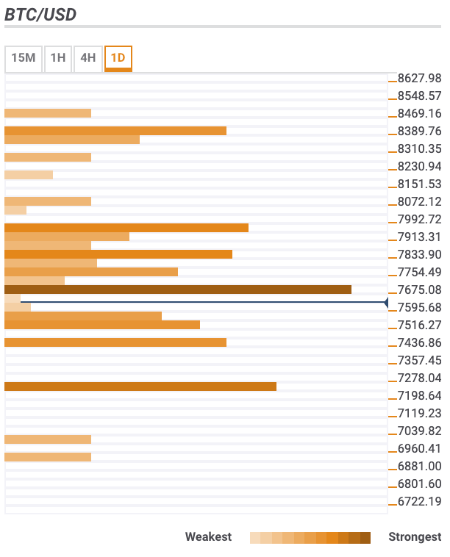

Bitcoin confluence levels

There are quite a number of technical barriers, including the Simple Moving Averages (SMA) clustered on both sides of the current price. It means that Bitcoin might spend some time in a range before the directional move is resumed.

Resistance levels

$7,700 – a confluence of technical levels located right below the current price includes 23.6% Fibo retracement daily, 38.2% Fibo retracement weekly, the lower line of 4-hour Bollinger Band, SMA10 and SMA5 1-hour.

$7,800 DMA5 and DMA10.

$8,000 – 23.6% Fibo retracement weekly, SMA100 1-hour, Pivot Point 1-day Resistance 1.

Support levels

$7,500 – Pivot Point 1-month Resistance 3.

$7,430 – Pivot Point 1-day Support 1.

$7,200 – 61.8% Fibo retracement weekly, SMA100 4-hour.