- Bitcoin bulls increased their entries after the price touched $34,000 on Friday.

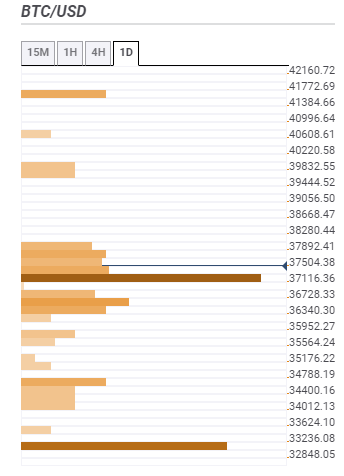

- The least resistance path is upwards, as validated by the confluence resistance tool.

Bitcoin hit $40,000 again on Friday but could not sustain the uptrend. Thus, a reversal came into the picture. Following the correction, BTC hit sub $34,000 before allowing for the ongoing recovery. The least resistance path seems upwards, for now, as the bulls aim to close the weekend session above $40,000.

Bitcoin renews the uptrend for gains eyeing $40,000

The pioneer cryptocurrency is exchanging hands at $37,363 and within an ascending parallel channel. On the upside, bulls are working to overcome the selling pressure at $38,000, which will pave the way for testing the channel’s middle boundary.

Simultaneously, the Relative Strength Index has validated the bullish outlook with the reversal above the midline. Continued action toward the overbought region will call for more buy orders.

Bitcoin is known for moving significantly over the weekend. Therefore, if enough tailwind behind it, gains above $40,000 are a conservative prediction. Besides, a daily close above the midline may help add weight to the bullish narrative.

BTC/USD daily chart

The bullish outlook has been validated by the confluence detector tool, revealing no significant resistance ahead of the largest cryptocurrency. On the downside, robust support is holding Bitcoin in place, perhaps assuring investors that the corr3ection is unlikely in the near term.

This initial support calls $37,116 home and is highlighted by the 4-hour previous high, the 4-hour Bollinger band middle boundary, the SMA ten 15-minutes, and the one-month pivot point support one.

BTC/USD confluence levels

It is worth mentioning that Bitcoin’s downtrend will resume if the price closes the day below $38,000. Selling orders will surge on breaking under $37,000. BTC/USD could seek higher support at $34,000. However, $30,000 is still within reach.

%20-%202021-01-16T123500.011-637463884065971681.png)