- Bitcoin must clear the strong resistance at $8,281 in order to revive movement towards $9,000.

- Bitcoin settled in a narrow range with the upside capped at $8,300 and the downside protected around $8,200.

Bitcoin led the market in a brief recovery staged on Sunday during the American session. The momentum saw Bitcoin reclaim the ground it had lost above $8,000. The leg up touched $8,300 but failed to advance towards $8,400. Meanwhile, Bitcoin is settling in a narrow range between $8,200 support and $8,300 resistance.

The granddaddy of cryptocurrencies is up 3.42% in the last 24 hours. In the same period, $15 billion in volume has been exchanged across cryptocurrency exchanges. Bitcoin has a market of $148 billion which commands a 66.7% dominance.

More: Bitcoin price analysis: BTC/USD brushes shoulders with $8,300, where to next?

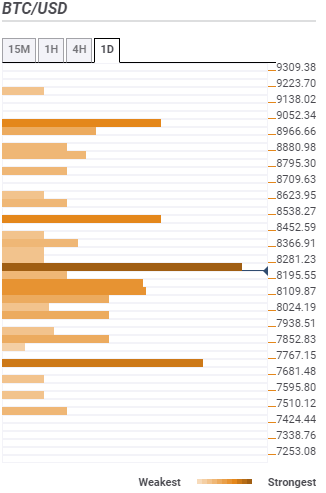

Bitcoin confluence levels

The unique confluence detector tool places the initial resistance at $8,281. The resistance in this zone emanates from a cluster of indicators including the ten Simple Moving Average (SMA) 15-minutes, the previous high 15-mins, previous high one-hour, the Bollinger Band 15-minutes upper and the previous high four-hour.

Although the above zone is the strongest resistance at the moment, the movement above it will come face to face with the medium resistance at $8,538. On the brighter side, trading above $8,538 is likely to pave the way for gains above $9,000.

On the flip side, support is quite limited. Although, $8,195 will try to hold in the event a reversal occurs towards $8,000. Some of the indicators here are the SMA ten one-day, SMA 100 four-hour, SMA 50 four-hour and Fibonacci 38.25% one-day.

More confluence levels