- Bitcoin’s upside trend is gaining momentum.

- Critical $11,000 remains the key barrier to be taken out.

BTC/USD staged a good recovery on Thursday. However, the upside momentum faded away on approach to $10,700 barrier. The longer-term bullish target of $11,000 is still out of reach, while a slow market activity suggests that we are in for another period of consolidation in a new range.

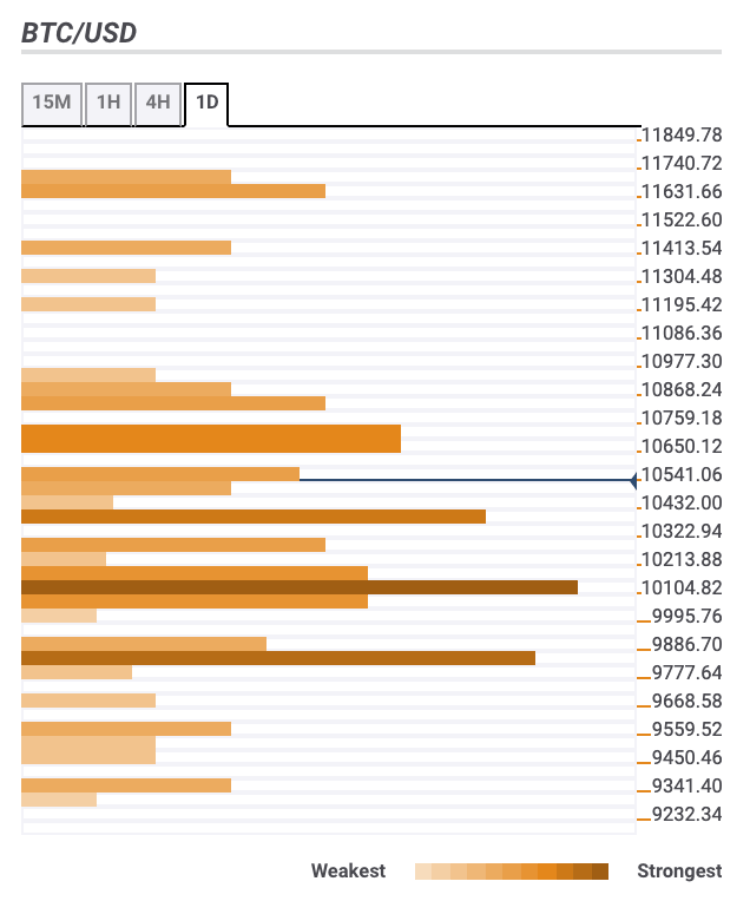

Bitcoin confluence levels

There are some important technical barriers, both above and below the current price. It means that the first digital asset might need new catalysts to proceed with the recovery.

Let’s have a closer look at the barriers that might influence Bitcoin’s movements in the short run.

Resistance levels

$10,700 – psychological barrier, Pivot Point 1-week Resistance 1, Pivot Point 1-daily Resistance 1, 38.2% Fibo retracement monthly, SMA200 (Simple Moving Average) daily 4-hour, the upper line of 1-hour Bollinger Band

$10,850 – the highest level of the previous week.

$11,000 – psychological level, the upper line of 1-day Bollinger Band

Support levels

$10,100 – 38.2% Fibo retracement weekly, 23.6% Fibo retracement monthly, SMA50 1-hour;

$9,700 – the lower line of 1-hour Bollinger Band, SMA200 1-hour, 23.6% Fibo retracement weekly;

$9,500 – Pivot POint 1-day Support 3.