- BTC/USD is consolidating losses mostly unchanged since the beginning of the day.

- The critical resistance is seen on approach to $10,100.

Bitcoin (BTC) has been range-bound on Friday. At the time of writing, BTC/USD is changing hands at $9,470, down 1.5% on a day-on-day basis and stayed mostly unchanged since the beginning of the day.

Meanwhile, The Chief Executive Officer of Pacific Capital Peter Schiff believes that Bitcoin cannot be considered a safe-haven asset as it failed to recover amid risk-aversion on the global markets.

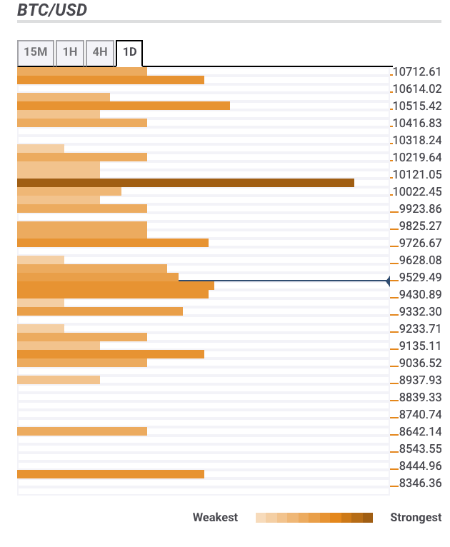

Bitcoin confluence levels

There are strong technical levels located on both sides of the current price. It means that the coin may continue to move sideways in the short-term; however, a strong catalyst into the end of the week may push the price out of the range and create a strong trend.

Let’s have a closer look at the barriers that might influence Bitcoin’s movements in the short run.

Resistance levels

$9,700 – SMA50 (Simple Moving Average) 1-hour, SMA200 15-min, Pivot Point 1-day Resistance 1.

$10,100 – SMA100 (Simple Moving Average) daily, SMA40 4-hour, SMA200 1-hour, 23.6% Fibo retracement monthly.

$10,550 – 38.2% Fibo retracement weekly, SMA50 daily

Support levels

$9,400 – the lower lines of 1-hour and 1-day Bollinger Bands, 23.6% Fibo retracement daily;

$9,100 – the lowest level of the previous month;

$8,600 – Pivot Point 1-week Support 3;

$8,400 – Pivot Point 1-month Support 1.