- BTC/USD continues trading sideways currently at $9,722 after another significant rejection from $9,870.

- There are numerous resistance points toward $10,000.

Bitcoin has defended the daily 12-EMA on June 9 again, which means the digital asset has defended the support level seven days in a row. BTC/USD is still flat and trading sideways but has seen a volatile move on June 9, peaking at around $9,870 before quickly dropping to $9,500 and even $9,300 on some exchanges.

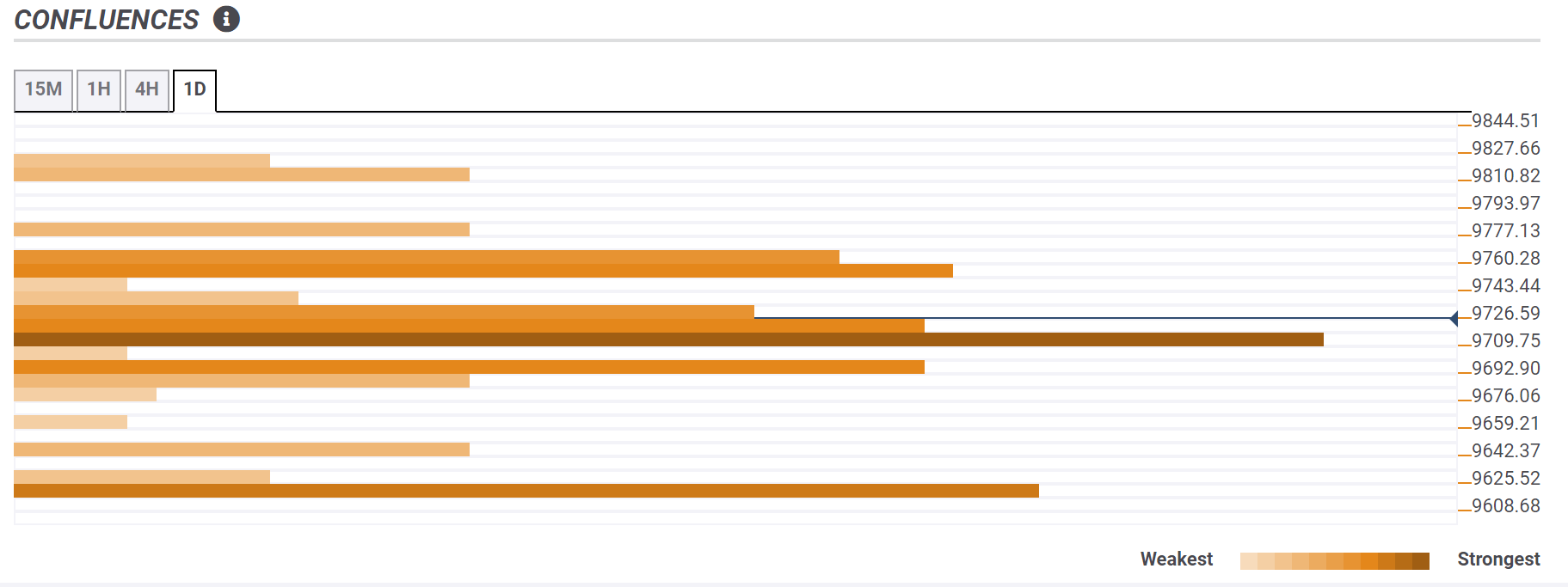

Bitcoin has recovered and continues trading sideways. Bulls are looking at $9,760 resistance level where the daily Fibonacci 38.2% and the upper Bollinger Band on the 15-minutes chart are converging. There is also a resistance point closeby between $9,760 and $9,777 where the upper Bollinger Band on the hourly currently stands.

The area between $9,760 and $9,827 seems to be full of resistance levels but Bitcoin is also enjoying strong support levels.

Right below the current price of $9,726, there is a huge area of support until $9,709 where many indicators are converging. We have the middle Bollinger Band, the SMA10 and the previous low on the 15-minute chart. The SMA 5 on the hourly, the SMA 5 on the 4-hour and the SMA10 on the daily. There is also the SMA100 on the 15-minute chart, the middle Bollinger band on the hourly chart, the Fibonacci 61.8% on the daily and the Fibonacci 38.2% on the weekly, all converging in the same area of support.

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

This tool assigns a certain amount of “weight” to each indicator, and this “weight” can influence adjacent price levels. These weightings mean that one price level without any indicator or moving average but under the influence of two “strongly weighted” levels accumulate more resistance than their neighbors. In these cases, the tool signals resistance in apparently empty areas.

Learn more about Technical Confluence