- The bulls are anxiously waiting for a correction above $3,900.

- Bitcoin’s daily trading volume is still elevated above the $10 billion mark.

- If the breakout fails and Bitcoin turns around, expect it to clear the support at $3,800 and move towards $3,700.

The cryptocurrency market is breaking out as I settle down to draft this incredible piece on the largest digital asset by market capitalization Bitcoin. The outlook of the market shows green everywhere with most cryptos recording gains between 05% and 5%. It is likely that cryptocurrencies led by Bitcoin will close the week trading in the green having corrected from the intraday lows.

The 4-hour BTC/USD shows Bitcoin trading at $3,884 after breaking past the 50 SMA resistance. The bulls are anxiously waiting for a correction above $3,900. A move that is likely to reignite further upwards movement towards $4,000.

Meanwhile, Bitcoin’s daily trading volume is still elevated above the $10 billion mark. The volume is defying the technical theory that investors lose interest amid periods of price consolidation. However, the current consolidation is likely to culminate in a breakout as far as the price-volume analysis shows.

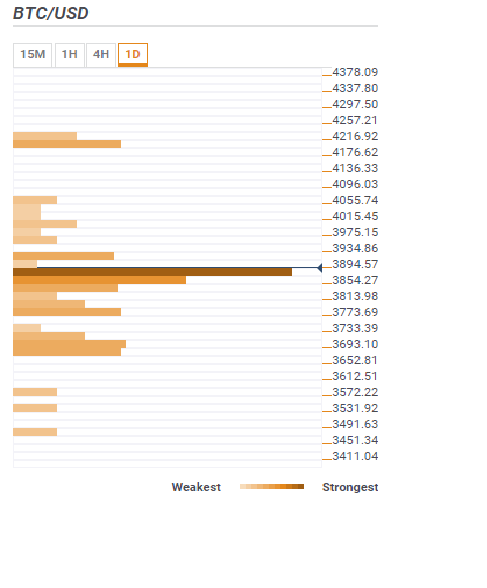

As far as technical levels are concerned, the confluence indicator tool places the initial vital resistance at $3,894.51. This zone is host to a confluence of indicators including the 5 SMA 4-hour, the 100 SMA 15’chart, the 38.2% Fibonacci level daily chart, Bollinger Band middle curve 1-hour, the previous high 15′ chart, previous high 1-hour and the Bollinger Band 4-hour upper. A second hurdle is seen at $3.934.86 highlighted by the previous high 1-day, the pivot point 1-day R1 and the previous week.

Above this level, Bitcoin will face some of the weakest resistance zones. If supported by the high daily volume, we could see a breakout towards $4,200 allowing the bulls to stage another journey to $4,500.

Meanwhile, if the breakout fails and Bitcoin turns around, expect it to clear the support at $3,800 and move towards $3,700. There are other weak support levels at $3,854.27, $3,813.98, $3,773.69 and $3,733.39.