- Bitcoin second assault on $10,800 failed to yield results paving the way for an ongoing correction towards $10,500 support.

- Bitcoin requires a catalyst to give it a kick above $11,000 and launch in a trajectory to $12,000.

Bitcoin was largely depressed on Wednesday as it retreated from the barrier around $10,800. The bearish price action extended below $10,400. Impressively, a reversal staged during the Asian trading hours on Thursday zoomed above $10,800 but hit brakes at $10,835. At the momentum, BTC is trading at $10,554 while enduring the retreat following the second rejection at $10,800

Meanwhile, Bitcoin’s dominance on the market continues to hit new yearly highs. At 70.8%, Bitcoin effect on the market cannot go unnoticed. The last time Bitcoin’s dominance hit these levels was in March 2017.

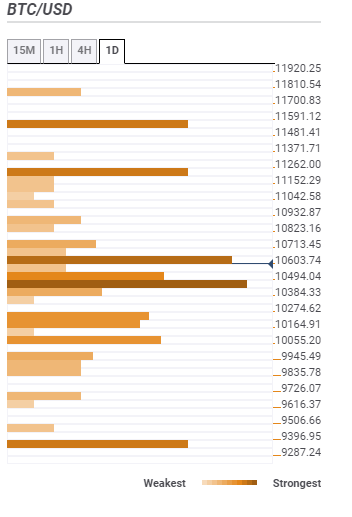

Bitcoin confluence levels

A glance at the confluence detector tool by FXStreet shows Bitcoin hauled between key support and a strong resistance zones. The first resistance at $10,603.74 has an intense concentration of technical levels ranging from the SMA 10 15-mins, Bollinger Band 1-h middle, 38.2% daily, SMA 100 15-mins, previous high 15-mins and the SMA 200 4-hour among others.

Bitcoin requires a catalyst to give it a kick above this key resistance for a revisit of the levels above $11,000. Besides, the path is almost clear until the next hurdle at $11,262. Further up, $11,591 will hinder growth towards the $12,000 psychological level.

Importantly, the most significant support is placed at $10,494. Converging here are several indicators including the Fibonacci 38.2% 1-min, Fibo 23.6% 1-day and the BB Band 15-mins lower curve. In the event declines progress, $10,274, $10,052 and $9,396 will come in handy to cushion the dips.

More confluence levels