- Bitcoin price retests $12,000 as predicted by Bloomberg; more upside action still expected.

- JP Morgan Chase & Co. invests in ConsenSys renewing institutional interest in Bitcoin and cryptocurrencies.

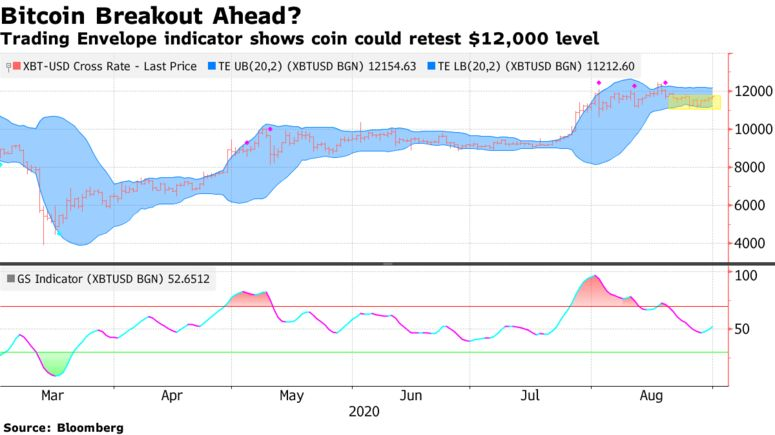

Bitcoin has been forced to dwell in a market dominated by little to no action. However, according to Bloomberg, the largest cryptocurrency has the potential to spike significantly higher especially if a key level is breached as shown by technical indicators.

The trading over the weekend saw BTC bounce off the lower Trading Envelop band. As predicted, the largest crypto rose to test $12,000 on Tuesday but the action has been limited marginally below the same level. The Trading Envelop band helps to smooth moving averages in a bid to print out higher and lower limits. Bloomberg explains that “the GTI Global Strength Indicator shows the coin has entered a new buying trend and isn’t in overbought territory, portending further gains.”

Bloomberg believes that Bitcoin has not yet hit its potential for 2020 especially with institutional investors still warming to the investment opportunities it brings forth. Last week Fidelity Investments released the first Bitcoin fund. Increasing involvement by traditional investors was also reflected by JP Morgan Chase & Co. which recently made an investment in ConsenSys. With more institutional investment companies joining the crypto world, there is likely to be an influx in capital pouring into the industry, eventually driving Bitcoin higher.

Bitcoin technical analysis

It is vital that Bitcoin reclaims the ground above $12,000 as soon as possible. More action is expected above this level as more funds trickle into the market from institutional involvement. However, the longer Bitcoin stays under $12,000, the bears get stronger. This means that support at $11,100 may not be enough to hold the intense pressure. In this case, BTC could refresh lows towards $10,000.

In the meantime, consolidation is likely to take precedence with support at $11,800 (the 50% Fibo), holding well. The RSI also puts emphasis on the possible sideways action. The same situation is reflected by the MACD as it moves horizontally at 116.

%20(30)-637346202602713722.png)