- BTC/USD is consolidating gains mostly unchanged since the beginning of the day.

- The critical resistance is seen on approach to $10,700.

Bitcoin (BTC) has been range-bound with bullish bias during European hours on Wednesday. The first digital asset has settled marginally above $10,500; however the further upside looks limited at this stage as the market is waiting for new developments in the global markets.

Read also: No-deal Brexit to push Bitcoin (BTC) to new record high

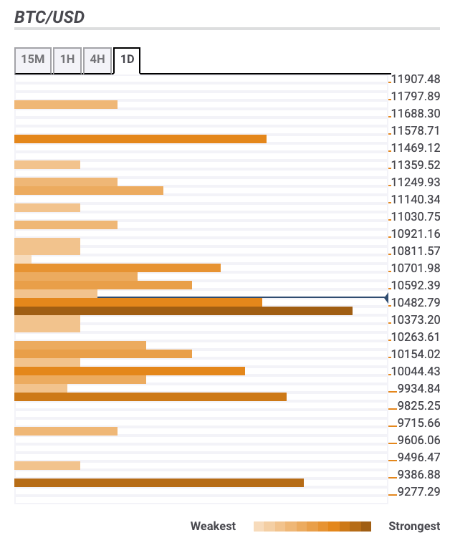

Bitcoin confluence levels

There are a lot of technical barriers both above and below the current price, which confirms the short-term consolidation pattern. As optimism returned to the market, the recovery looks more likely provided that the price manages to resume growth within the next trading sessions.

Let’s have a closer look at the barriers that might influence Bitcoin’s movements in the short run.

Resistance levels

$10,600 – SMA200 (Simple Moving Average) 4-hour, the upper and the middle lines of 15-min Bollinger Band;

$10,700 – 23.6% Fibo retracement daily, the highest level of the previous week;

$11,000 – psychological level, the upper lines of 4-hour and 1-day Bollinger Band

Support levels

$10,450 – SMA50 daily, SMA50 1-hour, SMA200 15-min;

$10,000 – SMA100 1-hour, 23.6% Fibo retracement monthly;

$9,800 – 38.2% Fibo retracement weekly, Pivot Point 1-day Support 3.