- Bitcoin bulls must push for movement to the upside and even step above $4,200 in the short-term.

- Bitcoin price could easily correction above $4,100 and test the next significant resistance at $4,218.73.

BTC/USD finally managed to resume the uptrend above the key level at $4,000. Since the drop on Sunday last week, Bitcoin bulls have been struggling to reverse the trend upwards and retrace the steps above $4,000 until today. Although we had a breakout during the early session on Thursday, the bullish momentum came to halt at last week’s highs around $4,040. At the time of writing, Bitcoin is back in red and changing hands at $4,028.

It is important that support is established above $4,000 to prevent any declines towards this week’s support at $3,950. In fact, the bulls must push for movement to the upside and even step above $4,200; a move that is expected to ignite gains to higher levels.

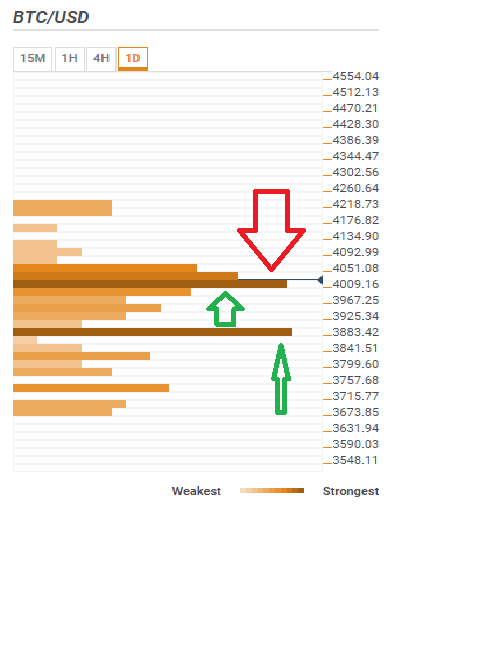

According to the confluence detector tool, BTC/USD must overcome the initial hurdle at $4,051.08 to stage more gains. This hurdle is highlighted by a confluence of indicators including the Bollinger Band 15′ upper, 10 SMA 1-hour, 5 SMA 15′, 10 SMA 15′, previous high 1-hour, Bollinger Band 4-hour upper, Bollinger Band 1-day upper, Bollinger Band 15′ upper, previous high 4-hour, previous high daily, pivot point 1-day R1 and the Bollinger Band 1-hour upper. If the bulls manage to correct above this level, Bitcoin price could easily correction above $4,100 and test the next significant resistance at $4,218.73.

As far as the downside is concerned, BTC/USD is strongly supported at $4,0009.16 by various indicators such as the 5 SMA daily, Bollinger Band 1-hour lower, 61.8% Fib level daily, 50 SMA 1-hour, 200 SMA 15′, the 161.8% Fib level weekly, pivot point weekly R2 and the 10 SMA 4-hour. Another key support is seen at $3,883.42 highlighted by the 100 SMA 4-hour, pivot point weekly S3, the 38.2% Fib level 1′, the 61.8% Fib level weekly and the Bollinger Band 1-day middle curve. If Bitcoin clears this support, it is very likely that it will breakdown further towards $3,600 and event test $3,500.