- BTC/USD is hovering around $10,300 amid range-bound ahead of the European opening.

- The next critical resistance awaits BTC bulls at $10,700.

Bitcoin (BTC) has entered a rangebound phase after a strong growth during early Asian hours. The first digital currency hit $10,668 amid notable anti-risk sentiments caused by the US-China trade war escalation. However, the upside proved to be unsustainable so far as the price failed to clear a technical barrier created on approach to $10,700.

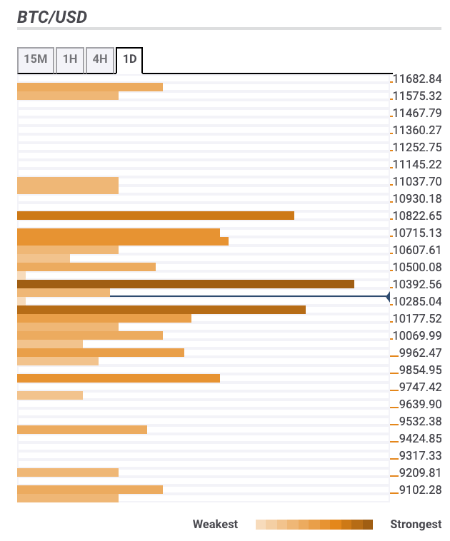

Bitcoin confluence levels

There are some strong technical levels both above and below the current price, which means the coin may spend some time in a range, waiting for new catalysts. However, considering highly volatile markets and flight to safety, another sharp move in either direction should not be excluded.

Let’s have a closer look at the barriers that might influence Bitcoin’s movements in the short run.

Resistance levels

$10,400 – SMA10 (Simple Moving Average) 1-day, SMA5 15-min, SMA5 1-hour, the middle line of 15-min Bollinger Band.

$10,700 – psychological level, 23.6% Fibo retracement weekly, SMA50 daily, the highest level of the previous 4 hours.

$10,900 – Pivot Point 1-day Resistance 3, the middle line of 4-day Bollinger Band.

Support levels

$10,150 – the middle lines of 4-hour and 1-hour Bollinger Bands, 61.8% Fibo retracement levels on daily and weekly timeframes, SMA5 daily

$10,000- $9,950 – SMA100 daily, the lower line of 4-hour Bollinger Band

$9,800 – Pivot Point 1-week Support 1, the lowest level of the previous week.