- Bitcoin dominance drops as the price weakens four months in a row.

- Bitcoin bulls are in for a battle as resistance builds towards $9,000.

Bitcoin dominance in the cryptocurrency has significantly thinned over the last four months. Then granddaddy of cryptocurrencies commanded over 70% of the crypto market between June and July. However, the growing altcoin dominance coupled with the weakening Bitcoin price has seen tumble to 65.84%.

The data on CoinMarketCap shows Bitcoin having shed 2.2% of its value in the last 24 hours. Bitcoin’s market features a $19 billion trading volume in the same period which is a minor drop from the $20 billion recorded yesterday.

The cryptocurrency live rates on the day show Bitcoin with a relative change of +10. The price has made a subtle upward correction of $0.14 to trade at $$8,095. The prevailing trend is bullish amid shrinking volatility.

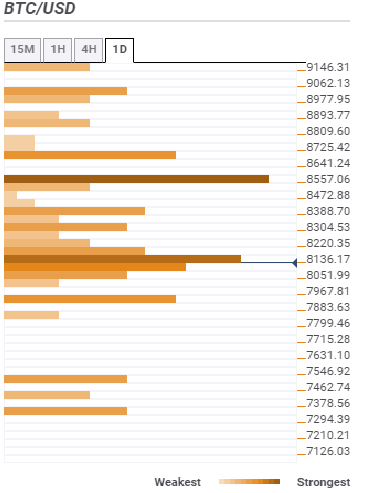

Bitcoin confluence levels

Bitcoin buyers are faced with an immediate resistance at $8,136. Meeting here are various technical indicators including the 50 SMA 1-hour, the SMA 200 15-minutes, the SMA 10 1-hour, the previous high 15-mins, the Bollinger Band 15-mins upper curve and the BB 1-hour upper curve to mention a few.

Consequently, a breakout above the first resistance must be strong enough to deal with the sellers’ congestion at $8,557. The region is home to the 61.8% one-month, the SA ten one-day and the Fibo 23.6% one-week. Trading action above his zone will remain relatively smooth towards $9,000 accept for some small bumps at $8,725 and $8,893.

Unfortunately, the confluence tool displays a relatively week support for Bitcoin. The first medium-strong support is highlighted at $8,051 and is host to the BB one-day lower, previous low one-day and BB one-hour lower. The next target is $7,967 followed by $7,546 and $7,378.

More confluence levels