- BTC/USD is vulnerable to further losses as the recovery falters.

- A sustainable move above $8,050 will take the price to $7,800.

Bitcoin (BTC) is changing hands marginally below $8,100. The first digital coin managed to regain some ground, having gained about 1% of its value in a matter of hours ahead of the European opening. Despite the recovery, BTC is vulnerable to further losses as the upside momentum is weak so far.

Read also: Institutional investors not scared by Bitcoin sell-off – Grayscale report

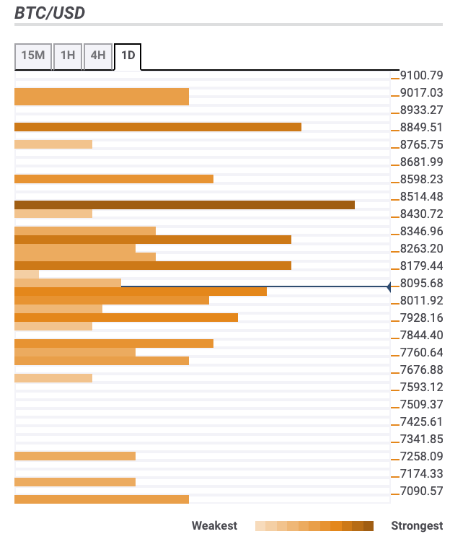

Bitcoin confluence levels

During early European hours BTC/USD tested area above $8,100. Despite the recovery from the intraday lows, the upside momentum remains weak, which poses risks for Bitcoin. There are a few barriers both below and above the current price, though the move to the South looks like a path of least resistance.

Let’s have a closer look at the technical levels that may serve as resistance and support areas for the coin.

Resistance levels

$8,150 – Pivot Point one-day Resistatnce 1, 61.8% Fibo retracement weekly, SMA50 (Simple Moving Average) one-hour;

$8,300 – Pivot Point one-day Resistatnce 2, SMA10 daily;

$8,500 – 23.6% Fibo retracement monthly, 38.2% Fibo retracement weekly, the upper line of the four-hour Bollinger Band;

Support levels

$8,00 – psychological level 23.6% Fibo retracement daily, the middle line of one-hour Bollinger Band, SMA10 one hour;

$7,800 – the lower line of the Bollinger Band on one-hour, four-hour and daily timeframes

$7,800 – the lowest levels of the previous week, Pivot Point one-day Support 2.