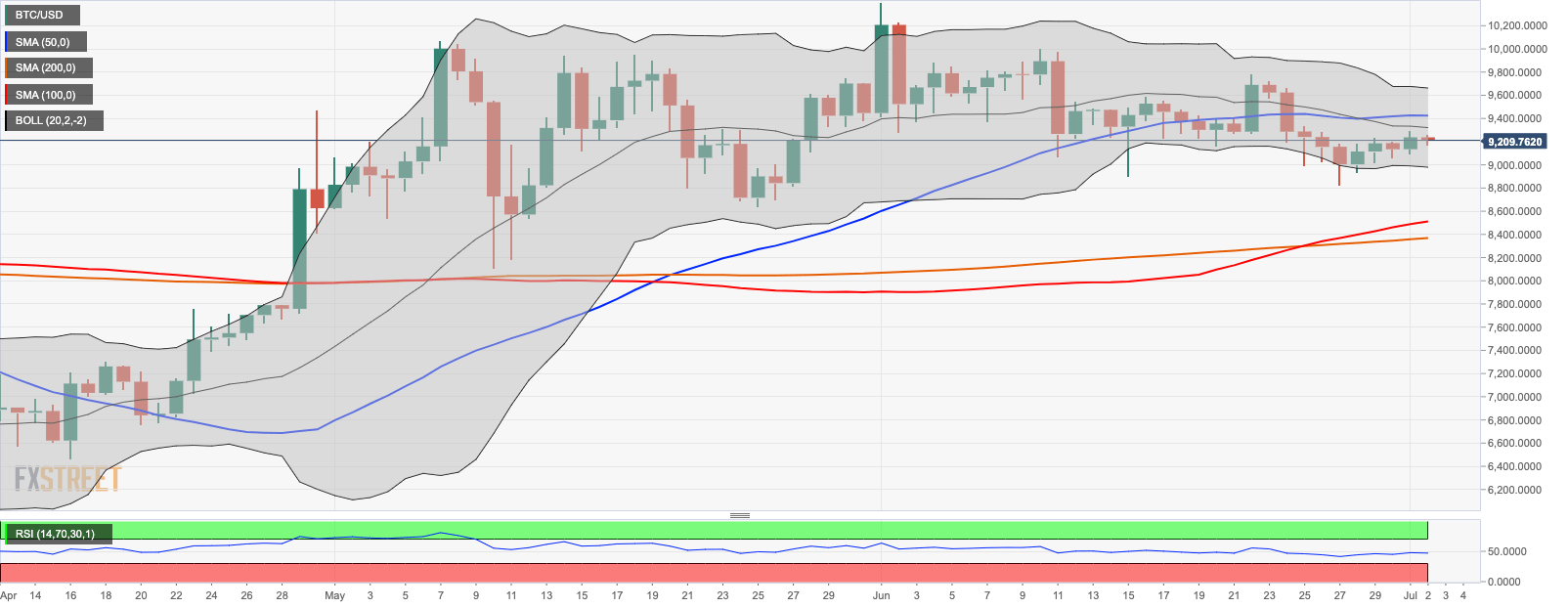

- BTC/USD bulls lose the initiative, push the coin back inside the range

- An important support is created by $9,000 handle.

Bitcoin (BTC) resumed the decline after a failed attempt to keep the upside momentum after a move above $9,200. The first digital asset hit the intraday high at $9,288 and retreated to $9,200 by the time of writing. On the intraday level, the coin has been moving within a short-term bearish bias within the recent tight range.

BTC/USD 1-hour chart

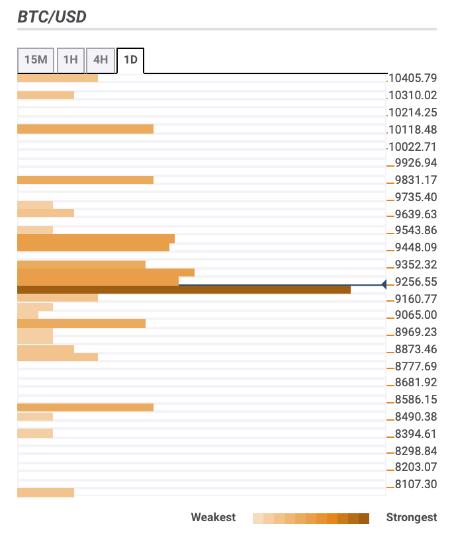

Bitcoin confluence levels

BTC/USD has been oscillating in a range since the start of the week, which means the coin may be vulnerable to sharp movements in either direction, once the motion is triggered. The upside is the path of least resistance at this stage; however, a move below the current support level may result in a violent sell-off. Let’s have a closer look at the technical levels.

Resistance levels

$9,300 – lower upper of 1-hour and 4-hour Bollinger Bands, 38.2% Fibo retracement weekly, 4-hour SMA100

$9,500 – 4-hour SMA200, 61.8% Fibo retracement weekly

$9,800 – the highest level of the previous month, 61.8% Fibo retracement monthly

Support levels

$9,150 – 1-hour SMA50 and SMA200, 4-hour SMA50, 61.8% Fibo retracement daily, the middle line of the 4-hour Bollinger Band

$9,000 – the lower line of the daily Bollinger Band, the lowest level of the previous week

$8,500 – Pivot Point 1-month Support 1, Pivot Point 1-week Support 2.