- BTC/USD is consolidating in a tight range with a bearish bias.

- The critical resistance is seen on approach to $10,000.

Bitcoin (BTC) has been range-bound with bearish bias after Monday sell-off from the upper boundary of the recent consolidation channel. The first digital asset dropped to $10,191 during Asian hours but managed to recover above $10,200 ahead of European opening. At the time of writing BTC/USD is changing hands at $10,265. Notably, the coin’s market share settled at 69.7%.

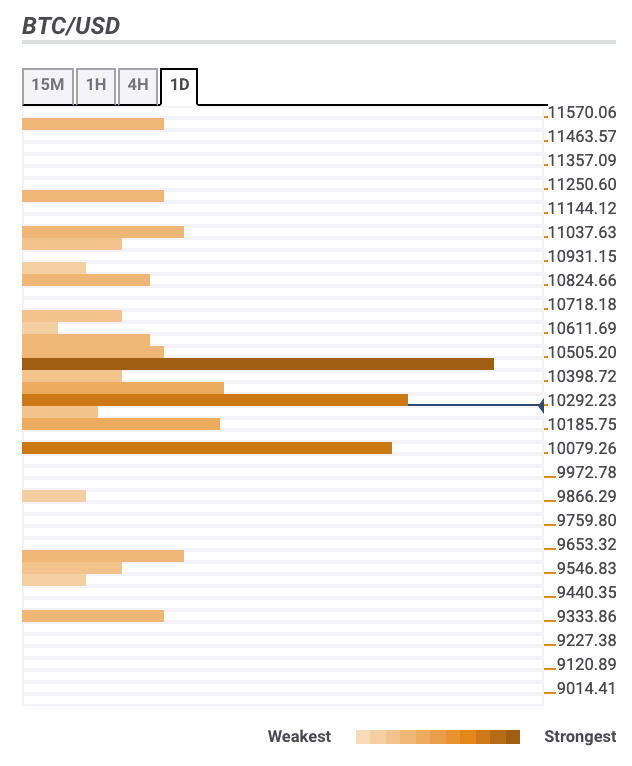

Bitcoin confluence levels

There are a few technical levels both above and below the current price, which means that Bitcoin might stay range-bound in the near-term. A neutral position of the Relative Strength Index (RSI) on the intraday charts supports this scenario.

Let’s have a closer look at the barriers that might influence Bitcoin’s movements in the short run.

Resistance levels

$10,300 – SMA10 (Simple Moving Average) 1-hour, SMA10 1-day, 38.2% Fibo retracement daily, the middle line of 1-hour Bollinger Band.

$10,500 – SMA100 and SMA200 1-hour, SMA50 daily, SMA50 and SMA200 4-hour;

$10,800 – 161.8% Fibo projection.

Support levels

$10,000 – 61.8% Fibo retracement weekly, 23.6% Fibo retracement monthly, Pivot Point 1-day Support 1;

$9,500 – Pivot Point 1-day Support 3, Pivot Point 1-week Support 1;

$9,300 – the lowest level of the previous month.