- BTC/USD bulls have staged a weak comeback following three consecutive bearish days.

- There is only one support level keeping the price above $8,000.

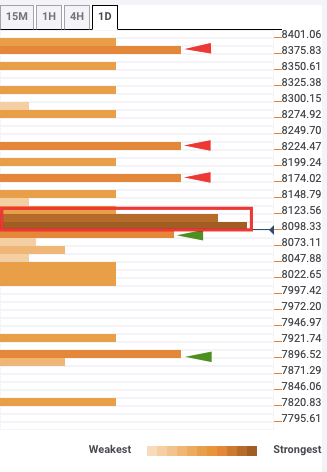

After three consecutive bearish days, BTC/USD bulls are mounting a weak comeback. So far this Thursday, they managed to pick up the price from $8,085 to $8,102. The daily confluence detector shows us that currently, the price is stuck between heavy levels of support and resistance. On the upside, there is a resistance stack from $8,095-$8,120 and normal levels at – $8,180, $8,230 and $8,380. Support levels are at $8,080 and $7,900.

BTC/USD daily confluence detector

The $8,095-$8,120 stack has the 5-day Simple Moving Average (SMA 5), SMA 10, SMA 50, SMA 100, SMA 200, 4-hour previous high, one-day Fibonacci 38.2% retracement level, 15-min previous high, one-hour previous high, 15-min Bollinger Band middle curve and one-hour Bollinger Band upper curve. $8,180 has the one-week Pivot Point support one and $8,230 has the 4-hour Bollinger Band middle curve and one-day previous high. Finally, $8,380 has the previous week low.

On the downside, $8,080 has the SMA 5, SMA 10, 15-min previous low, 15-min Bollinger Band middle curve ad one-day Fibonacci 23.6% retracement level. $7,900 has the one-week Pivot Point support two.