- The BTC/USD pair plays with key levels that would open the door to doubts and early sales.

- Bitcoin’s current scenario leaves little margin, just hours, for a new bullish leg in the short term.

- The $30,000 price level is the most likely target for a downward extension.

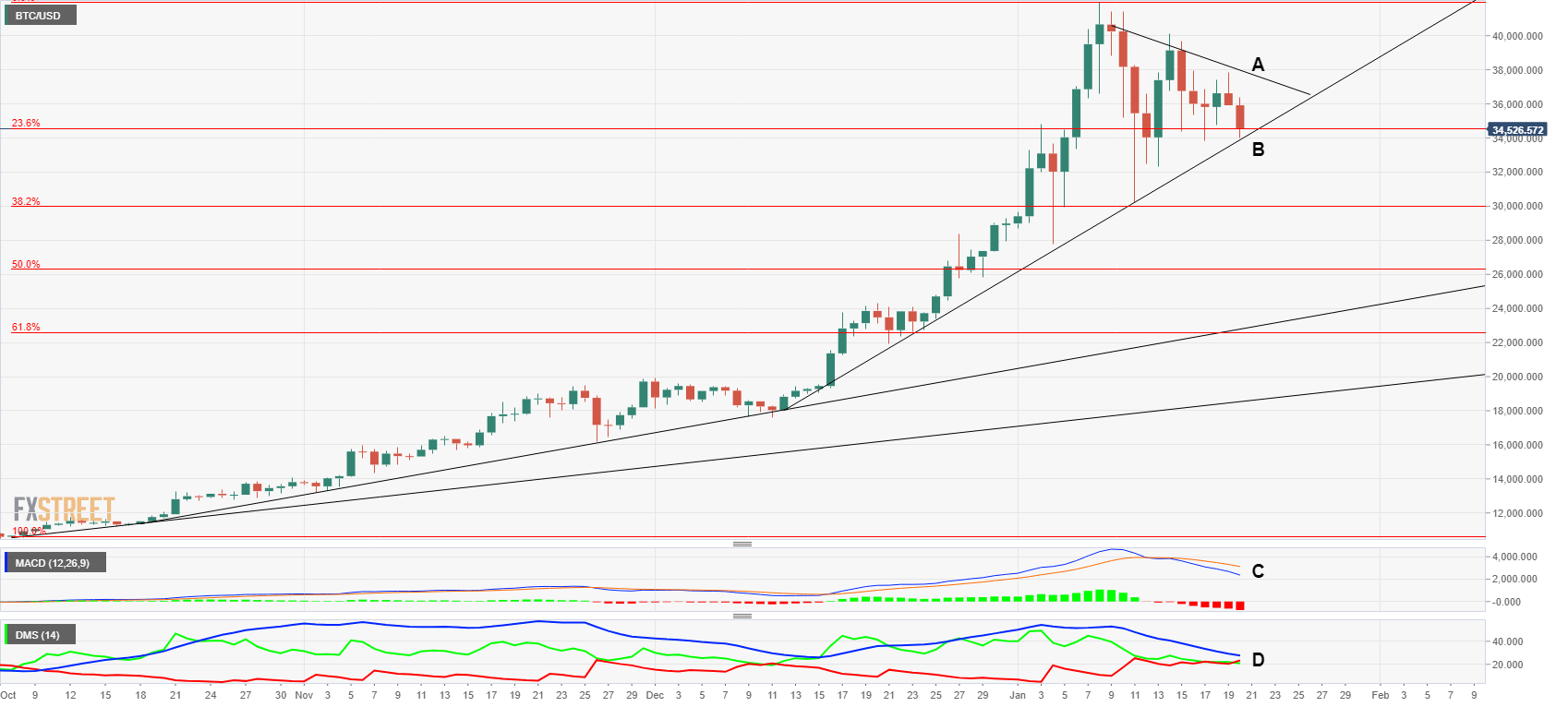

The BTC/USD pair has accelerated its decline to a few hours before the start of the US session. BTC price is moving away from the historical high and seeks support at the 23.6% level of the Fibonacci retracement system from the entire previous rally.

In the current position, BTC/USD is also finding support in the accelerating trend line that originated on December 11-12 (B).

If the price level of $34,000 is drilled down later in the session, it will undo the current triangle figure (A), and we would possibly see a more complex lateral downward development.

The primary target of a breakout and extension downward movement is at the $30,000 price level, where the 38.2% Fibonacci retracement system is located.

On the upside, a break above $38,000 is necessary to grant a move towards the recent high of $41,987 and beyond.

The MACD (C) in the daily range shows a bearish development profile that may be complex to reverse in today’s session but would accept an upward swing if it occurs before the weekend. Further bearish development of this indicator would push the options away from an additional upward leg.

The DMI (Directional Movement Indicator) (D) shows bears taking a small lead over bulls but still needing to break out of the ADX line, which would confirm the takeover of the BTC/USD by the sell side of the market.