- Bitcoin price must bring down the resistance at $7,408 in order to open the door for gains towards $8,000.

- Bitcoin price drop under $7,800 seems unlikely as long as $7,200 continues to function as a formidable support.

Bitcoin price flipped bullish at the beginning of this week cementing the bulls’ position on the market. Higher price action reclaimed support above $7,000 and extended the bullish leg above $7,400. Although, buyers pushed higher, the resistance at $7,500 remains unconquered.

At the time of writing, Bitcoin is trading at $7,287 while an intraday high has been reached at $7,426. The existing trend is bullish but the shrinking volatility hints that rapid price movement is not expected in the near term.

The 4-hour chart shows that BTC/USD is likely to close the day bearish especially if the RSI keeps on retreating from the overbought. On the other hand, the MACD’s horizontal movement hints that sideways could continue in the near term. Bitcoin is unlikely to drop below $7,000 as long as $7,200 keeps on functioning as a credible support area.

BTC/USD 4-hour chart

Bitcoin price confluence levels

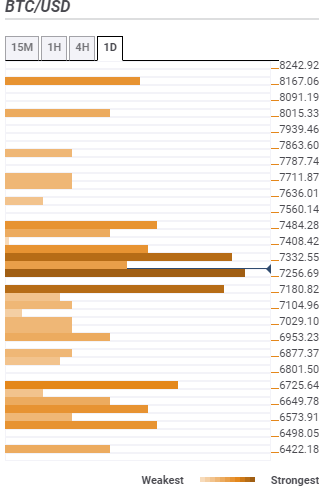

The confluence detector shows Bitcoin bullish action lagging behind the initial resistance at $7,332 as highlighted by the SMA 100 15-minutes, the previous high 15-mins, the Bollinger Band one-day upper curve and the Fibonacci 61.8% one-day. If the bulls manage to clear this level’s resistance, they must brace for more hurdles at $7,408, which happens to the tipping point for BTC. Extended action above $7,408 will boost the price towards $8,000, however, if Bitcoin stalls, it could be ammunition for the bears, likely to force Bitcoin under $7,000.

On the downside, the confluence tool places the first support at $7,256. Converging in this zone is the SMA 50 15-mins, previous low 1-hour, Bollinger band 15-mins lower and the BB 1-hour middle. Another key support area lies at $7,180 and is home to the Fibo 61.8% one-day. If push comes to shove and Bitcoin slides under $7,000, $6,725, $6,649 $6,573 are all tentative support areas.

More on confluence levels

-637219355054439195.png)