- Bitcoin Price retreats to $48,000 after reaching a swing high above $50,000.

- Bitcoin fundamentals may increase BTC buying appetite.

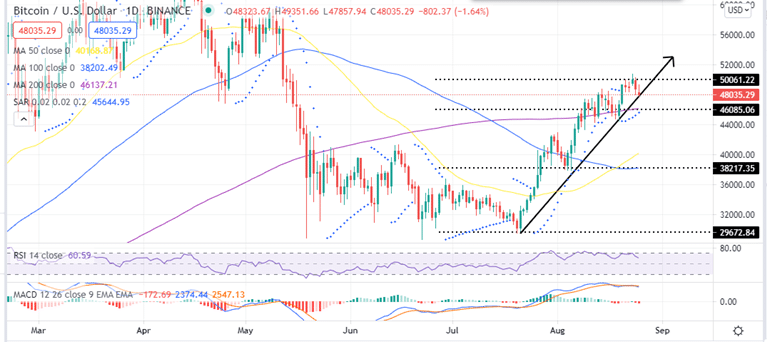

- Short term BTC price prediction is bearish as accentuated by the MACD and the RSI.

Bitcoin price was rejected by resistance from around the $50,000 psychological level after rising to a three-month high of $50, 822 on August 23. Data from Binance shows that bulls are struggling to keep the BTC price above $48,000 as sellers hold their ground.

As such, Bitcoin price prediction remains bearish after the bellwether cryptocurrency dropped 4% over the last 24 hours losing around $1,939 of its August 24 price.

However, on-chain metrics from IntoTheBlock show that show that a lot of investors (5.05 million addresses) are holding approximately 3.15 million BTC between the $33,588 and the $48,000 price range. These traders might want to push BTC higher so that they can collect prices.

Bitcoin Mining Hash Rate Reaches All Time High

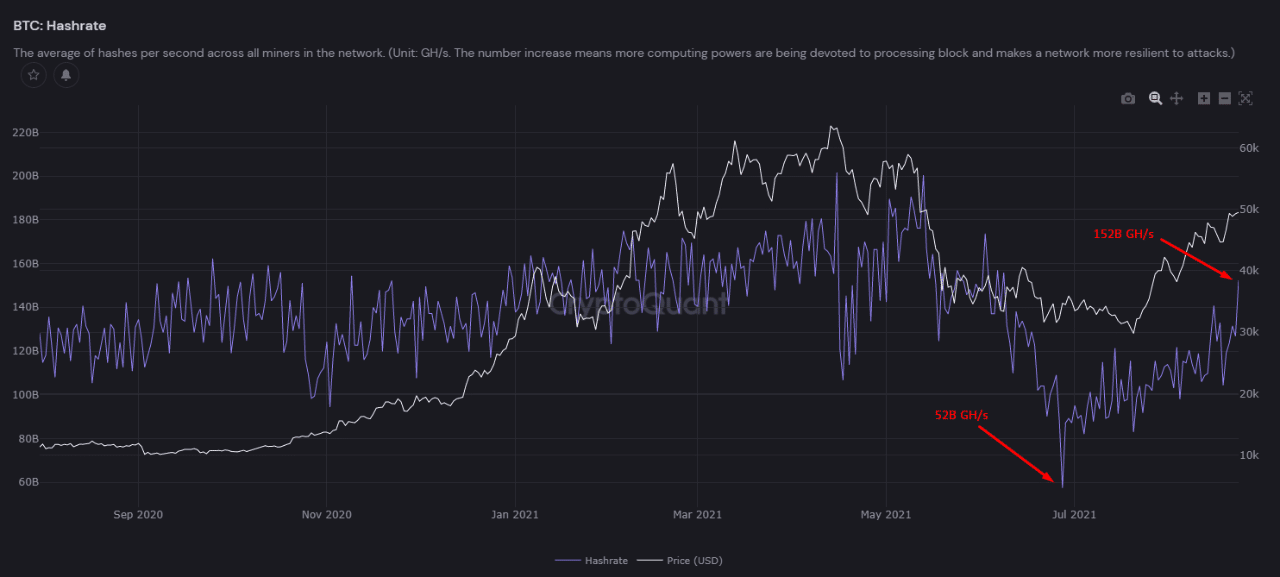

While things look awry for the bellwether cryptocurrency right now, its value is expected to increase in future even as the mining difficulty increases. This is validated by the latest data from analytics provider CryptoQuant that Bitcoin’s network hashrate has recovered remarkably since it crashed following China’s clampdown on Bitcoin miners early this year.

On Aug. 24, the CryptoQuant reported a hashrate of 152 EH/s which has more than tripled since it reached an all-time low at 52 EH/s in June.

BTC Hashrate Chart

This is good news for Bitcoin enthusiasts since the recovery of the BTC hashrate points to a more secure network that is harder to attack. This is likely to bolster the BTC price in the near future.

Increased Institutional Adoption May Increase Bitcoin Price Buying Appetite

Another development that BTC traders should look forward to is the increasing institutional adoption of cryptocurrencies. For example on Monday, the online payments giant PayPal announced that I was providing cryptocurrency services to its UK customers. This service will allow verified PayPal customers in UK to buy, sell and hold Bitcoin, Ethereum, Litecoin and Bitcoin cash.

This followed the provision of the same services to its US customers earlier this year. PayPal indicated that they intend to roll-out these services to their more that 400 million customers around the world in the near future.

With this, PayPal joins a growing list of companies that are continuously adopting blockchain technology and cryptocurrencies with retail giants like Amazon and Walmart recruiting cryptocurrency and blockchain experts. This points to increasing adoption of cryptocurrencies by companies and businesses.

Latest to join the bandwagon is Citigroup which is eeking to trade Chicago Mercantile Exchange (CME) Bitcoin futures once it receives regulatory approval. According to an inside source who spoke to CoinDesk, Citi is waiting to receive regulatory approval to start trading Bitcoin futures on the CME.

The second source that spoke to CoinDesk intimated that after the approval to trade CME Bitcoin futures, the bank will then seek approval to trade Bitcoin exchange-traded notes (ETNs) next. The bank is also hiring traders to work with Bitcoin futures as part of the crypto team in London.

Earlier, MicroStrategy, had purchased more Bitcoin adding 3,907 BTC to its BTC holdings. According to data from a Form 8-K filing with the United States SEC published on August 24, the business intelligence firm increased its Bitcoin holdings by 3,907 BTC between July 1 and Monday, August 23. The form also revealed that MicroStrategy used to the upside of $45,294 to purchase more Bitcoin.

These news on increasing institutional interest in the leading cryptocurrency comes on the heels of Bitcoin price brushing shoulders with the $50,000 mark for the first time since May. This rally marked an 87% increase in BTC’s market capitalization since falling to $30,681 on May 19.

Bitcoin Price to Retest The $46,000 Crucial Support

BTC/USD price is recoiling after reaching a three-month high above $50,000 on August 23. Bitcoin could drop to retest crucial support levels before re-starting the bullish leg.

The largest cryptocurrency by market capitalisation will explore support provided by the July rising trendline coinciding with the 200-day Simple Moving Average (SMA) at $46,085. Should BTC slide below this level, Bitcoin price may fall lower to test the $45,500 support base. Increased pressure from sellers could see the bulls retreat with the price of the flagship cryptocurrency falling further to tag the $42,000 level.

BTC/USD Daily Chart

Note that the Relative Strength Index’s (RSI) nose dive away from the overbought zone accentuates this bearish outlook.

Moreover, the Moving Average Convergence Divergence (MACD) indicator sent a call to sell signal yesterday. This occurred when the 12-day Exponential Moving Average (EMA) crossed below the 26-day EMA indicating that the bearish momentum has gained traction. Moreover, the movement of the MACD line below the signal line accentuates this bearish narrative.

On the upside, things may not be that bad for BTC bulls. The fact that the parabolic SAR still remains positive and that the Bitcoin price still remains above the July rising trendline, the odds of re-starting the bullish leg might not be that bad.

For this to happen, BTC must close the day above the $48,000 psychological level. However, a decisive breakout upwards will be determined if Bitcoin closes a daily candlestick above the immediate major resistance provided by the $50,000 psychological level to re-test the swing high above $50,515. Whether this will happen, it remains to be seen.

Where To Buy BTC?

At the time of writing, Bitcoin is trading at $48,035, 4% cheaper than yesterday’s high above $50,000. If you want to buy Bitcoin now, you can do so at the following crypto trading platforms:

- eToro

eToro is one an FCA regulated platform with over 20 million user globally. eToro charges low trading fees and commissions. - FTX

FTX is one of the largest exchange platforms that supports a wide range of cryptocurrencies and trading pairs. It also offers user-friendly features. - BinanceBinance is best crypto exchange for day trading digital currencies and offers hundreds of cryptocurrency pairs including fiat-to-crypto and crypto-cross markets. Binance is particularly great for trading smaller-cap coins and ERC-20 tokens.

Looking to buy or trade crypto now? Invest at eToro!

Capital at risk