- Bitcoin is ready to create a top and start a deep correction.

- A move above $26,800 may allow for another bullish wave.

Bitcoin (BTC) may be well-positioned for a further increase with all bullish fundamentals in place; however, the short-term picture implies that the pioneer digital asset has reached a local top and started a downside correction.

The retreats are not a catastrophe. They are an inherent part of a market cycle of any asset class, and cryptocurrencies are no exception here. Bull trends are not developed in a straight line. Instead, they develop in ebbs and flows, making the movement more sustainable and healthy.

Bitcoin’s price more than doubled in less than three months, meaning that the market is ripe for a correction. According to the social sentiment tracking data compiled by a behavioral analytical company Santiment, Bitcoin is close to FOMO levels, but not to the degree when the price usually tops.

It means that Bitcoin’s correction is imminent; however, the price may attempt another rally before the sell-off starts for real.

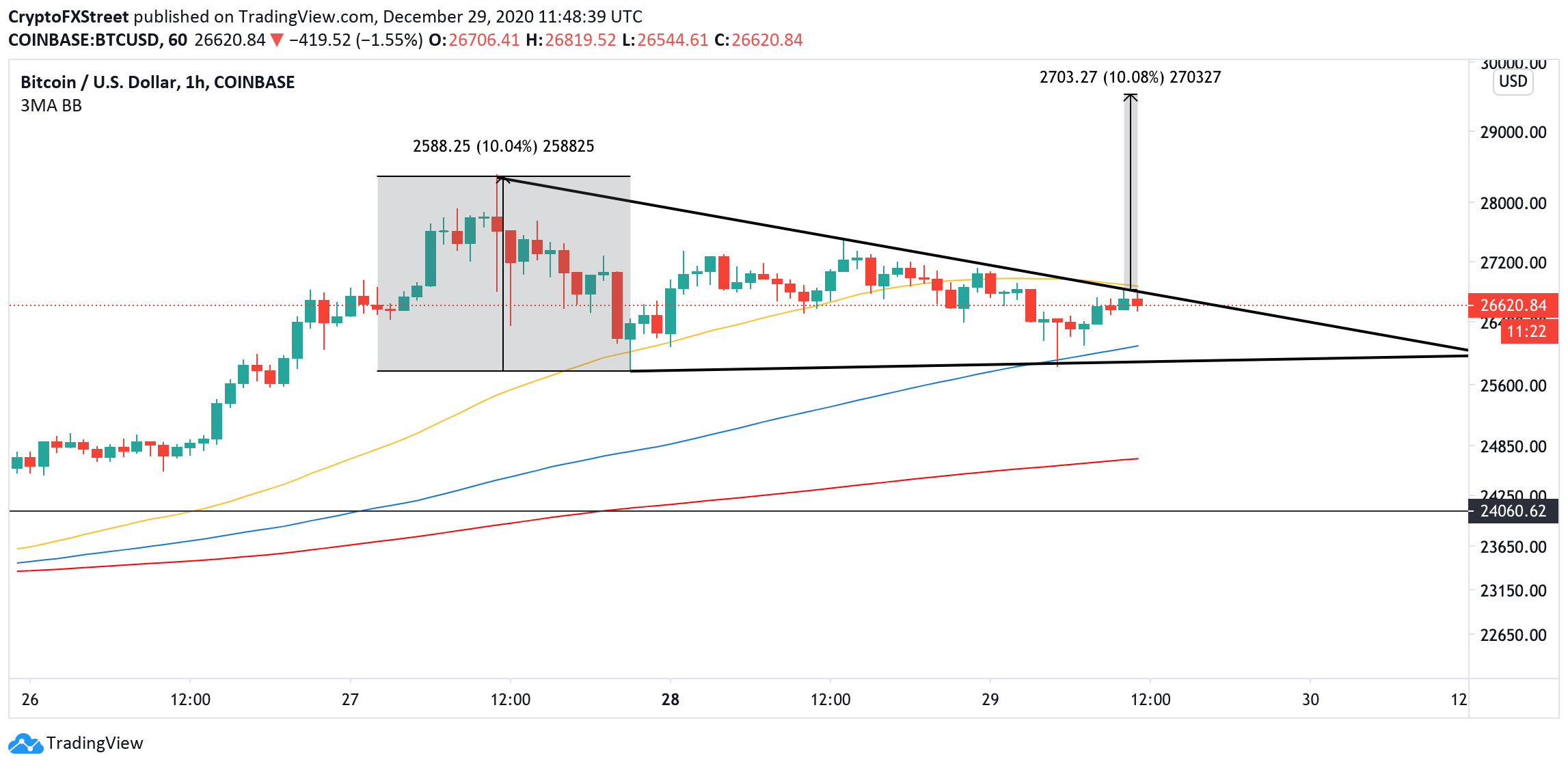

BTC tries to break from a descending triangle

On 1-hour chart, BTC is trying to break free from a descending triangle pattern with hypotenuse at $26,800 reinforced by 1-hour EMA50. Once it is broken, the recovery momentum may gain traction with an estimated target at $29,500, followed by the psychological $30,000. As FXStreet previously reported, This area coincides with a critical Fibo projection level and may serve as a strong barrier for BTC on its way to the North.

BTC, 1-hour chart

A rejection from $26,800 will push the price towards the triangle’s x-axis, which is currently reinforced by 1-hour EMA100. The bullish scenario will be invalidated if it gives way, meaning that BTC has topped for now at $28,250. In this case, the sell-off may start snowballing with the eventual bearish target at $24,500 (1-hour EMA200 and 4-hour EMA50) and $24,000.