- Bitcoin stays green on a weekly basis, rangebound on the shorter time-frames.

- Fundamental developments imply that Bitcoin is regarded as safe-haven.

- The short-term price recovery is limited by $12,300.

The cryptocurrency market has been a mixed picture this week. Bitcoin attempted to settle above $12,000 practically every single day of the week, though the efforts failed to yield positive results. At the time of writing, BTC/USD is changing hands at $11,850, unchanged on a day-on-day basis and 12% higher on a weekly basis.

As major altcoins stayed in red nursing losses from 3% to 15% week-on-week, Bitcoin’s market share reached new multi-month high at 69.6%. The total capitalization of all digital assets in circulation is registered at $303 billion.

What’s going on in the market

This week we have been discussing safe-haven features of Bitcoin. Is now on par with gold in troubled times? Or even better than gold? Cryptocurrency experts and traditional financial analysts shared their views and discussed how the current geopolitical landscape and the macroeconomic situation would influence Bitcoin price.

Thus, Bloomberg analysts found out the Bitcoin’s correlation with gold has increased more than twice in recent three months due to growing uncertainty amid trade wars escalation and a global trend on easing monetary policy.

Basically, experts define three major risks that may create a precondition for strong Bitcoin growth into the end of the year.

First, U.S.-China tensions have escalated as the conflicting parties raised the bets used Cold War techniques. China let yuan drop below critical 7.00 and naturally infuriated the USPresident Donald Trump. As the conflict goes beyond trading confrontations and transforms gradually into a full-fledged currency war, the experts try to understand the consequences for the world’s economy and the flow of money across the globe.

Read also: Bitcoin is correlated with Yuan devaluation – CEO of Circle

Second, several central banks, including the Reserve Bank of New Zealand and the central bank of Thailand, slashed rates, following a similar step taken by the US Fed. It means that the global monetary policy has tilted towards accommodation. New liquidity is ready to hit the market, and we will need to absorb it somehow. In that regard, cryptocurrencies may seem an attractive place to park extra bucks in hopes to get higher returns.

The last, but not the least, the risk of no-deal Brexit looms large. Britain is supposed to exit the EU by October 31, 2019; however, the parties are still far from reaching an agreement. According to Nicholas Gregory, CEO of blockchain firm CommerceBlock, no-deal Brexit could see a massive and unprecedented breakout, create turmoil across two major fiat currencies and trigger an identity crisis. A resulting flight to safety will push Bitcoin beyond the recent all-time high reached at $20,000 at the end of 2017.

Read also: No-deal Brexit to send Bitcoin to the stratosphere

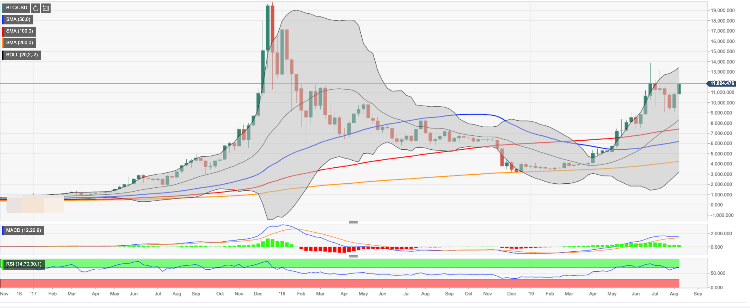

BTC/USD, 1W chart

Despite a failure to settle above critical $12,000, BTC/USD retains its long-term positive trend. Moreover, the first digital coin is poised to finish the second positive week in a row.

On a weekly chart, the price may be creating the double top pattern with the highest position marginally above $12,000 handle. We will need to see a reversal towards $10,000 and eventually to a prospective neckline at $9,500 to confirm this scenario. Once this barrier is broken, the sell-off will be extended towards the next psychological barrier of $8,000 and $8,300 (the middle line of 1-week Bollinger Band). That’s where Bitcoin bears are likely to hit the pause button.

On the upside, a sustainable move above this week’s high at $12,350 is a must for an extended recovery with the next focus on psychological $13,000, followed by the upper line of 1-week Bollinger Band at $13,400. We will need to see a sustainable move above this handle for the upside to gain traction and take us to %13,882 (the highest level of 2019) and, eventually to $14,000.

Considering that the RSI (Relative Strength Index) on a weekly chart starts to revers to the downside from overbought territory, the double-top scenario with the initial move towards the neckline at $9,500 looks likely. However, we will need to see a confirmation in the form of bearish breakthroughs on the intraday charts.

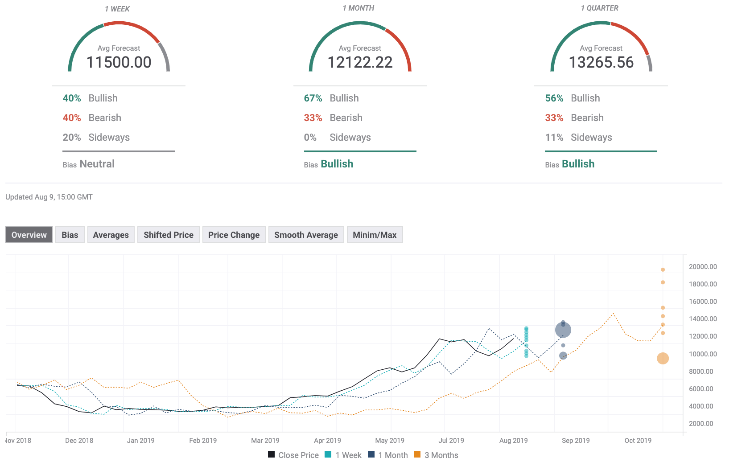

The Forecast Poll of experts improved since the previous week. The expectations on all time-frames have grown significantly with the majority of experts forecasting Bitcoin’s price above $13,000 on quarterly timeframe and above $12,00 on a monthly time-frames.