Bitcoin (BTC) has been listless for the best part of the week. Rare attempts to break free from the range yielded no result. At the time of writing, BTC/USD is knocking at $3,900 resistance, and everyone out there hopes that this time the upside will gain enough momentum to take us out of the range.

What’s going on in the market

This week was replete with news and comments from regulators and authorities. As always, the establishment is skeptical towards the cryptocurrency industry, seeing it a threat to financial stability and, obviously, the status quo. Thus, Swiss-based Basel Committee, supported by the Bank of International Settlements, said that cryptocurrencies could not reliably perform functions of money, while banks direct involvement in this industry require robust risk management and monitoring.

Meanwhile, the US regulators are bogged down in discussions about whether Ethereum is a security and how to regulate the whole thing.

Also, CBOE decided to skip Bitcoin future contracts in March due to low liquidity. At other times this news would have collapsed the market, but this time the cryptocurrency prices barely moved in response. It means that the participants are not responsive to fundamentals – both positive and negative – while the market is driven by sentiments and technical factors.

Moreover, altcoins demonstrate better momentum than Bitcoin, with many coins gaining ground this week. Stellar Lumens is the apparent leader with over 22% gains on a weekly basis. The coin got listed on Coinbase Pro. The announcement boosted XML price and pushed the coin to the 8th place in global cryptocurrency rating. NEM also demonstrated good momentum as the team managed to secure financing and provided a robust plan of restructuring.

Elsewhere, Monero successfully launched a hard fork to resist ASICs mining. The network experienced a hash rate reduction and the delays with transaction confirmations though the issues were temporary.

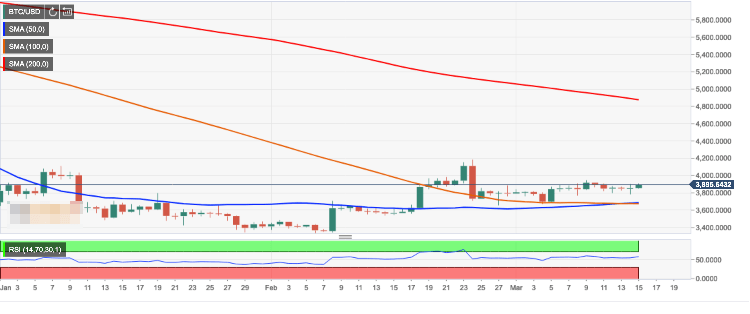

BTC/USD, 1D chart

The technical picture has barely changed from the previous Friday. BTC/USD is still suffering in a tight range limited by $3,900 on the upside and $3,800 on the downside. Once the price is out of this stifling prison, we will face new walls on both sides.

A confluence of DMA100 and DMA create strong support for BTC/USD on approach to $3,650. This area separates us from #3,400 guarded by all the more critical SMA200 on a weekly chart and $3,338 (the lowest level of 2019).

On the upside, once $3,900 is out of the way, $4,000-$4,200 will come into focus, which includes the highest level of the previous month and the highest level of 2019.

Considering that the Relative Strength Index on a daily chart is attempting to reverse higher, then the risks are skewed to the upside. However, only a sustainable move above $5,000 will signal the trend reversal.

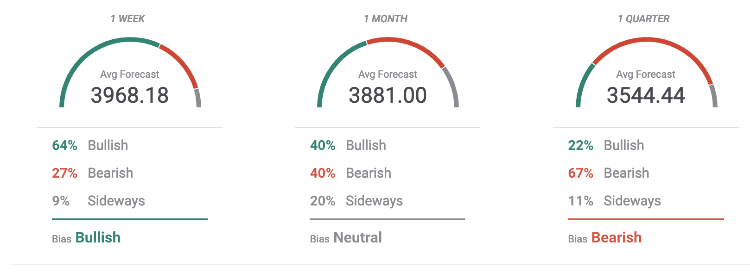

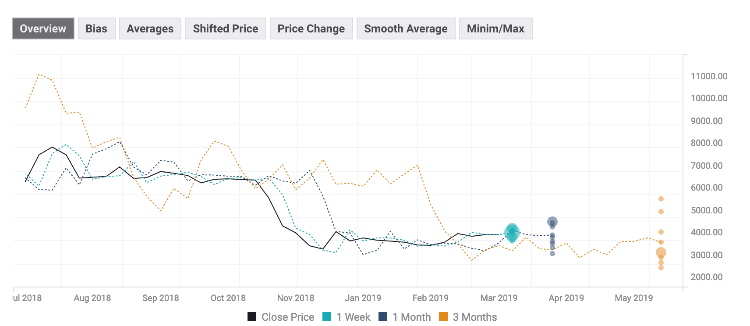

The Forecast Poll of experts shows that the market sentiments improved during the week; Both short-term and mid-term expectations are bullish, though in the longer-term time frame experts are more pessimistic. Unfortunately, the changces for a sustainable breakthrough above $4,000 are slim.