- Bitcoin dominance in the market diminishes as altcoins consolidate the recent gains.

- Reducing trading activity delays bullish flag pattern breakout.

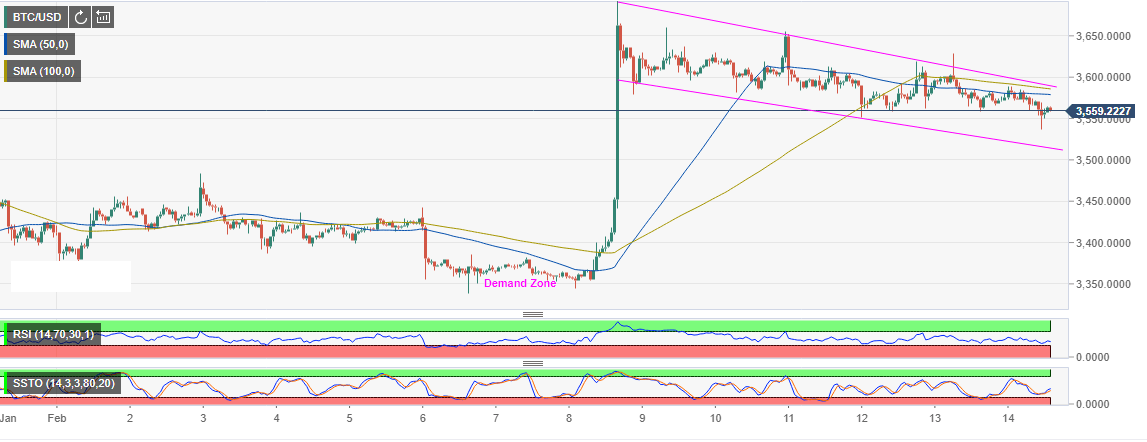

Bitcoin bulls are currently in retreat as the largest asset trims gains from the monthly high at $3,712. The trading since the beginning of this week has seen BTC/USD trend lower within the confines of a bullish flag pattern. However, the bulls have drawn a line in the sand at $3,550 thereby protecting the bullish flag pattern support.

Bitcoin market share has gone down slightly following the gains that affected the entire market last week on Friday. Bitcoin dominance has drop to the current 52.8% from the 2019 high of 53.3%. The trading volume is in dive from the recently achieved three month’s high at $7.7 billion. The market cap has also thinned from the highs around $64.6 billion to the current $63.3 billion.

Meanwhile, BTC/USD is trading at $3,559 and is below the hourly 50-day Simple Moving Average (SMA) and the 100-day SMA in the same range. The above-mentioned support has been tested severally but the buyers have put their best foot forward to ensure no declines extend beyond this level. In the event the bullish flag pattern support is breached, Bitcoin will be in danger of dropping further towards $3,400.

Lack of a catalyst to sustain the price above $3,600 is lagging a breakout from the pattern. BTC/USD must recover above $3,600 in order for the bulls to gather the strength to attack $3,700 (critical level). For now, I expect Bitcoin to continued trading sideways between $3,550 and $3,600 to the upside.

BTC/USD 1-hour chart